- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

You must file your extension request no later than the regular due date of your return. The D-410 and extension payments can be filed electronically through the Department of Revenues website.

Federal Income Tax Extension Requests Due Wednesday Wics

Federal Income Tax Extension Requests Due Wednesday Wics

Some states grant a six-month extension automatically others require that you file a request.

How to file a state tax extension. Fiscal year filers should contact us to request an extension. People apply for tax extensions for a wide array of reasons. They mostly relate to tax extension filing deadlines tax payment rules or certain tax extension forms to fill out or not in some states cases.

If you are in a situation where you need to file a tax extension you should consider consulting a professional first. Generally most states follow the same deadline to file a federal extension as well as accept federal extensions. To claim a time extension to file a return or pay tax write COMBAT ZONE on the income tax envelope and the top of the income tax return that you submit to us.

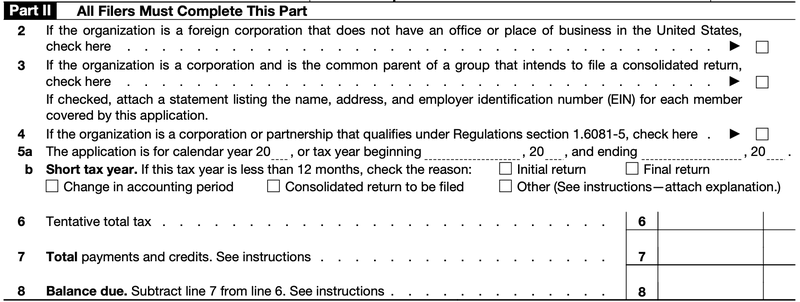

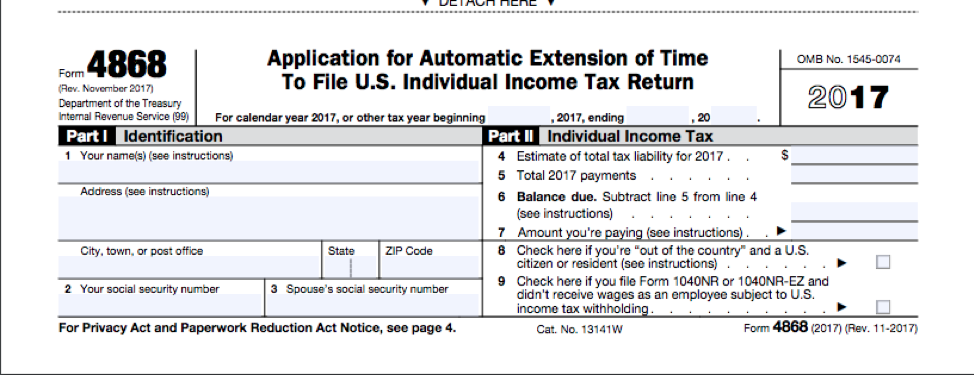

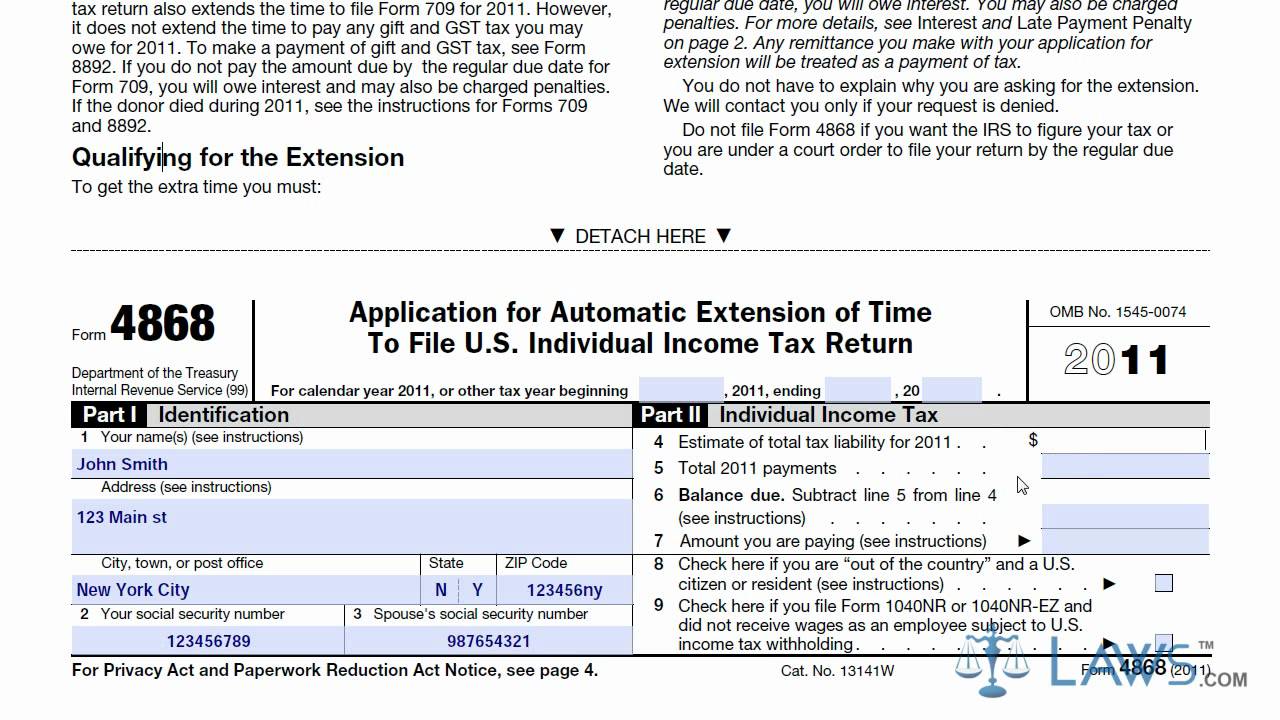

How to file a tax extension Submit your tax extension electronically or by mail. You owe tax for 2020. 45 Zeilen In order to request an extension of your federal taxes a Form 4868 must be completed before the.

For more information see Due Dates for Filing Individual Income Tax and Penalties and Interest. Those requirements usually relate to separate filing deadlines tax payment rules or specific forms to file or not file. Unless the taxpayer is outside the US the Department will not grant an extension for more than six months.

The requirements for filing a state tax extension vary from state to state. You must file your 2020 state tax return by Nov. Most states will give you an automatic 6-month extension of time to file if an extension was filed for the Federal return.

This extension is for filing only. To get the extension you must estimate your tax liability on this. You do not have to submit a separate form requesting an extension to file.

The state automatically grants a four-month extension to file if you reside outside the United States and Puerto Rico and an additional two-month extension can be obtained by filing Form D-410. How Do I File a State Tax Extension. You can also pay by credit card.

To avoid other penalties and interest you must pay any tax owed by the regular due date and file your return by October 15. Use Payment for Automatic Extension for Individuals FTB 3519 to make a payment by mail if both of the following apply. If you have a federal extension of time to file you automatically have an extension of time to file with Indiana.

Free eFile is available for. The due date for 2020 Indiana Individual Income Tax Returns was extended from April 15 to May 17 2021. While other states will give you an automatic extension without filing one for your Federal return.

However other requirements vary based on state. Whether it be personal illness family tragedy financial hardship or some other type of emergency tax extensions are not uncommon. An extension of time to file does not extend the payment deadline.

However in general most states follow the deadline to file a federal tax return extension. E-file Your Extension Form for Free. The procedure for filing state tax extensions varies by state so contact your state tax agency to verify the rules.

Learn how to file a. An extension to file your tax return is not an extension to pay. If filing electronically write COMBAT ZONE next to your name or on an address line if necessary along with the date of deployment.

You can pay by direct debit if you file electronically. EFile - File Form D-410 and remit your tax payment using a tax professional or commercial tax preparation software see list of approved eFile vendors. You can apply for a North Carolina extension and pay your tax online using the following options.

You cannot file your 2020 tax return by May 17 2021. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Regardless of which method you choose youll need to fill out Form 4868 and submit it by the IRSs extended deadline of May 17 2021.

Just as with your federal return you still must pay your best estimate of the state taxes that you owe. Filing this form gives you until October 15 to file a return. 15 2021 and pay any balance due with that filing.

Requesting an Extension of Time to File State Income Tax Returns The Department will grant an extension of time to file a PA income tax return up to six months. If your paid preparer is required to e-file your tax return and is also preparing your extension request the preparer must e-file your extension request. Pay the amount you owe by May 17 to avoid penalties and interest.

Using eFile allows you to file federal and State forms at the same time or separately. If you do owe additional state tax and need an extension of time to file you must ifile or file Form PV by the due date and enclose a check or money order for the amount you expect to owe. The online and e-file options provide you with a confirmation that we received your extension request.

Heres how to do it. How do I file a State Extension with my return.

How To File A Business Tax Extension In 2021 The Blueprint

How To File A Business Tax Extension In 2021 The Blueprint

How To File For A Business Tax Extension Federal Bench Accounting

How To File For A Business Tax Extension Federal Bench Accounting

How To File For An Extension Of State Taxes Turbotax Tax Tips Videos

How To File For An Extension Of State Taxes Turbotax Tax Tips Videos

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Tax Day Ny How To File For A Tax Extension From The Irs New York

Tax Day Ny How To File For A Tax Extension From The Irs New York

How To Get An Extension On Filing Federal And State Taxes

How To File A Tax Extension White Coat Investor

How To File A Tax Extension White Coat Investor

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486990777-56a938bc3df78cf772a4e5f7.jpg) How To File A Tax Extension For A Federal Return

How To File A Tax Extension For A Federal Return

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

State Tax Extension Filing For 2020 2021

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

Comments

Post a Comment