- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

The Roth IRA has no opening or annual fees. Log in to your employee benefits on NetBenefits.

Fidelity Ira Match Switch And They Ll Match Your Contributions Up To 10 My Money Blog

Fidelity Ira Match Switch And They Ll Match Your Contributions Up To 10 My Money Blog

Wealthfront offers free financial planning for college planning retirement and homebuying.

Fidelity roth ira open account. For a regular brokerage account Fidelity requires a minimum opening deposit of 2500. To fund an account. But for a retirement account there is no minimum required.

High potential for tax-free withdrawals and growth upon meeting the set conditions. Get up to 3000 when you open and fund within 60 days of account opening a new ETRADE brokerage or retirement account by. The first 5000 in your account is managed free.

Fidelity minimum initial deposit to open ROTH IRA Traditional IRA Simple IRA or SEP IRA. Fidelity full and partial account transfers are free. When you open the account your money will most likely sit in a money market account or something similar until youve actually chosen a fund to invest in.

The commission for an online US. Fidelity minimum balance requirement for brokerage or IRA. Fidelity minimum amount to open brokerage margin account.

Fidelity IRA Fees and Minimums Retirement accounts at Fidelity come with no account minimums no inactivity fees and no annual fees. For a limited time only. Nonetheless depending on the types of investments held some fund management or trading fees may apply.

Account Features - 5 5. Your account is professionally managed for a very low fee of 025 of your account balance. Accounts receiving over 100000 of net new assets will receive 500 free trades.

National Financial Services LLC Statement of Financial Condition. To open an account. Accounts receiving 50000 to 99999 will receive 300 free trades.

There are several IRA types available at Fidelity. For a regular brokerage account the firm requires an initial deposit of at least 2500 to open an account although for an IRA there is no minimum. How to Open a Fidelity Roth IRA Bank Account in 10 minutes 2021l Watch later.

My partner had a rIRA for 4 years before I met him and the money sat in the money market account until I saw and fixed it. Best Roth IRAs to open. Equity trade is 495 per trade.

There are no minimums or account fees to open a Roth Fidelity IRA account. Provider Commissions Minimum to open How to begin. You can open a Roth IRA account with as little as 500.

It offers a large variety of investments choices. Make sure the money you put in your Roth IRA is actually invested. Use of this site involves the electronic transmission of personal financial information.

2500 or 200 per month for ROTH and Traditional IRA. Identifying information Social Security number date of birth etc Contact information legalmailing address email address phone number Employment information if applicable occupation employers name and address Identifying information for the minor account owner. Log in to Fidelity Charitable SM.

These include Roth Traditional Rollover SEP SIMPLE Inherited and Minor accounts. In order to receive the free trades you must designate an existing eligible Fidelity IRA or brokerage account or open and fund a new eligible Fidelity IRA or brokerage account. If playback doesnt begin shortly try restarting your device.

2500 in cash andor securities.

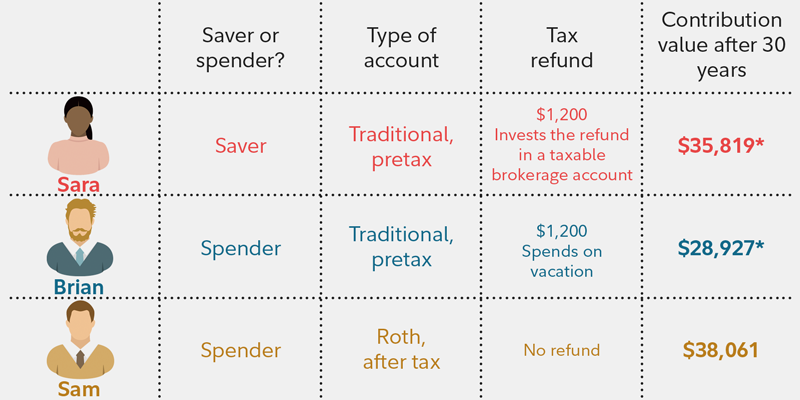

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

Fidelity Ira Fees Roth Retirement Account Cost 2021

Fidelity Ira Fees Roth Retirement Account Cost 2021

Mega Backdoor Roth Through Fidelity Investments Cerebraltax

Mega Backdoor Roth Through Fidelity Investments Cerebraltax

Backdoor Roth Ira Ultimate Fidelity Step By Step Guide Fatroth

How To Open A Roth Ira At Fidelity Youtube

How To Open A Roth Ira At Fidelity Youtube

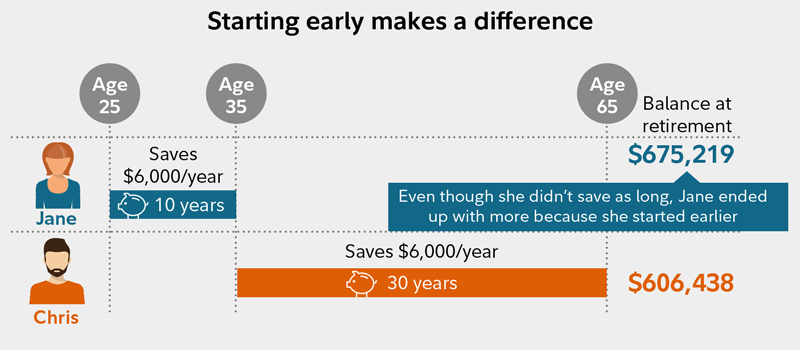

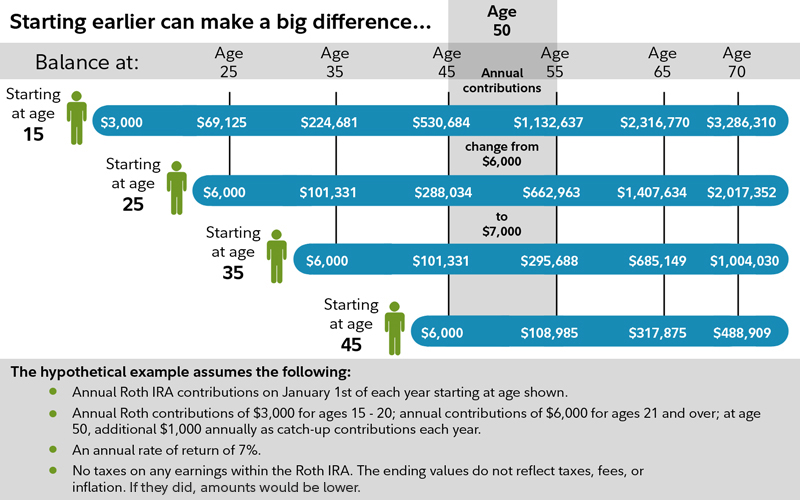

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

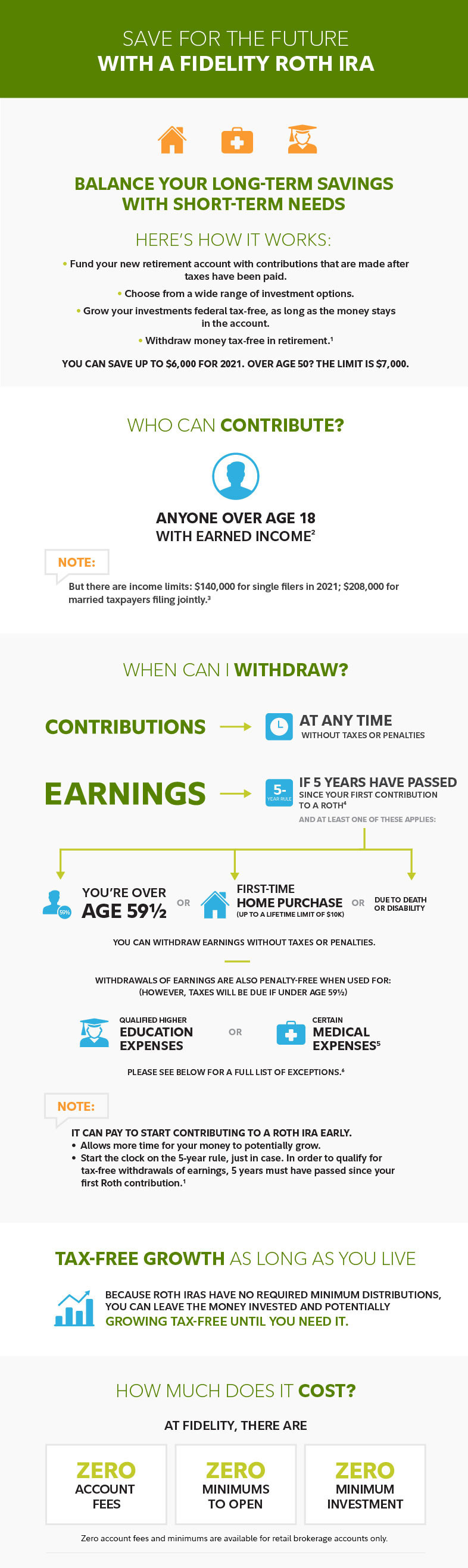

Roth Ira Saving For Your Future Fidelity

Roth Ira Saving For Your Future Fidelity

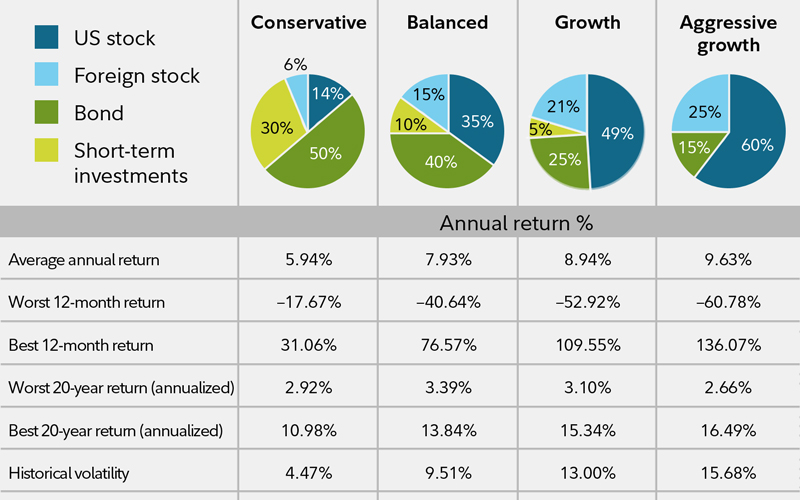

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

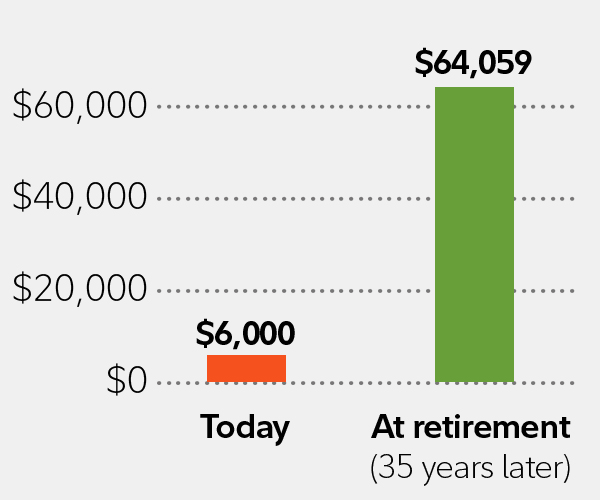

Why Contribute To An Ira Now Fidelity

Why Contribute To An Ira Now Fidelity

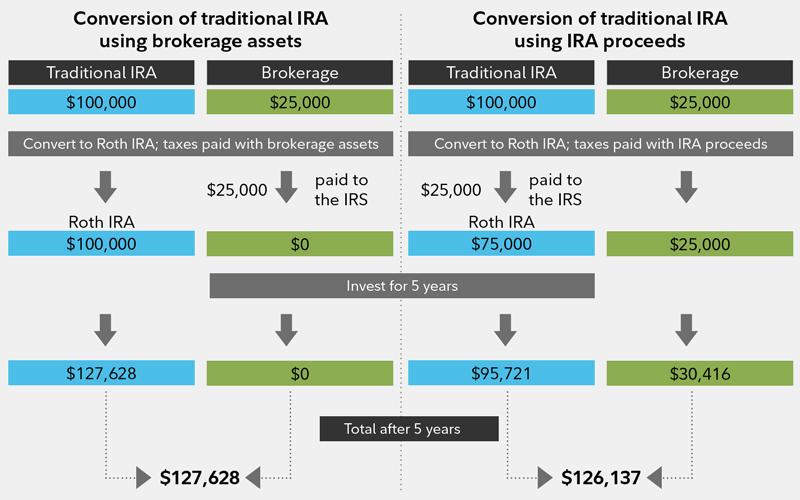

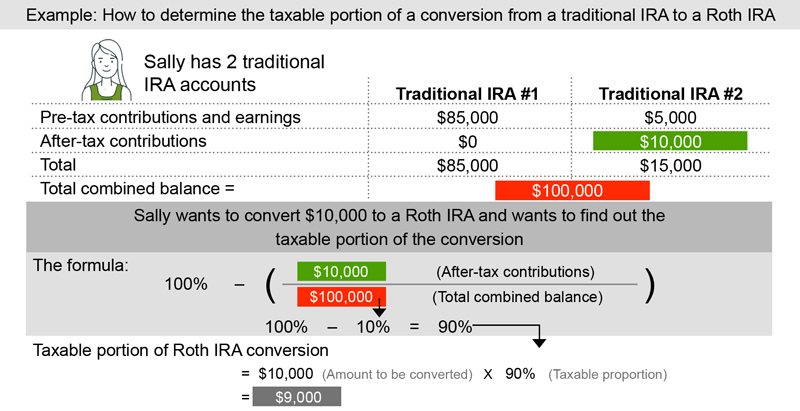

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Comments

Post a Comment