- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. In fact its starting price is nearly 10000 more than any rival shown here.

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

Which Electric Vehicles Still Qualify For Us Federal Tax Credit Electrek

How Much is the Electric Vehicle Tax Credit Worth.

Hybrid car tax credit 2020. With CO2 levels being reduced by around 20-25 hybrid cars are placed three to four tax. The IRS tax credit ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Car manufacturers such as Chevrolet and Tesla have become ineligible for Federal Tax Credits.

The amount of the tax credit ranges from 2500 to 7500 depending on the size of your battery. This credit is anywhere from 2500 up to 7500. South Carolina taxpaying residents who claim the following federal tax credits may also take advantage of a state income tax credit equal to 20 of that federal credit.

Federal EV Tax Credit Phase Out Tracker By Automaker. Updated through June 2020. For the next six months the cars were eligible for a 3750 credit which was then tapered down to.

Since the Sonata hybrid in this scenario isnt a plug-in there is no government tax credit. Individuals and businesses who buy a brand new hybrid electric or diesel fuel vehicle can take advantage of the Alternative Motor Vehicle Credit This tax credit applies to new cars and trucks that are certified for the credit by the IRS. Beginning on January 1 2020.

The amount of credit you are entitled to depends on. Vehicles that have been on the market for quite some times will start to get a phased out tax credit going from 7500 to 3750 1875 and then 0. You can enter the sales tax you paid for the car you purchased in 2020 by going to FederalDeductions and CreditsEstimates and Other Taxes Paid Sales Tax.

Audi A8 L 60 TFSI e Quattro 2021 6712. You will be asked if you paid sales tax on a major purchase and you will be able to enter the sales tax you paid for your new vehicle. 2020 Hybrid Car Tax Credit Federal Tax Credits for All-Electric and Plug-in Hybrid Vehicles Plug-in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500.

New qualified fuel cell motor vehicle credit. Tesla reached the milestone in July 2018 and. Examples of electric vehicles include.

For cars registered between March 2001 and March 2017 hybrids enjoy even greater VED benefits thanks to car tax being calculated entirely on CO2 emissions. The Toyota Highlander Hybrid has the highest MSRP on our list of the best hybrid and electric SUVs for the money. Tax Credit for Hybrids Fuel Cells Alternative Fuel and Lean Burn Vehicles.

Sales tax is an itemized deduction. The current tax law for hybrid cars allows for a credit when you buy an electric or plug-in hybrid vehicle. If you buy a fully electric car you can expect a credit of 7500 going towards you tax bill.

All about hybrid cars hybrid cars insurance hybrid cars tips pucture product. 4 2021 Toyota Highlander Hybrid. Mitsubishi Outlander PHEV Prius Prime Volvo XC60 PHEV.

Audi A8L PHEV 2020 6712. A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500. New advanced lean-burn technology motor vehicle credit.

The tax credit also only applies to new vehicles not used ones. Full Tax Credit. Some hybrid electric vehicles have smaller batteries and dont quality for the maximum tax credit amount.

Among the most popular measures introduced was the tax credit for purchasing fuel efficient cars. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. As for plug-in hybrids most qualify for a federal tax credit between 3500 and 6300.

Current and previous tax rates are shown on our car tax page. However a few qualify for the full federal EV tax credit including. Due to their lower tailpipe CO2 emissions car tax for hybrid cars is generally lower than it would be for a non-hybrid model.

Examples of plug-in hybrid electric vehicles include. Updated July 17 2020. How Much Is the EV Tax Credit.

Audi A3 e-tron 2016-2018 4502. A basic 1000 rebate for automobiles getting 65. Chevy Bolt Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche Taycan and Jaguar I-Pace.

Consumers analysts electric vehicle advocates lawmakers and others are all curious about what will happen to the growth in EV sales when the US Federal EV tax credit phases out partially or completely for some automakers. Lets say you buy a Nissan Leaf. GMs EVs and hybrids qualified for the full 7500 federal tax credit until Mar.

2020 and 2021 Toyota Rav4 Prime. Audi A7 55 TFSI e Quattro PHEV. 2020 Chrysler Pacifica Hybrid.

2020 Honda Clarity PHEV. The federal incentive is usually referred to as a flat 7500 credit but its only worth 7500 to someone whose tax bill at the end of the year is 7500 or more. Oddly enough Nissan with thousands of EVs sold since 2010 continues to get the full 7500 tax credit.

Electric Vehicles Tax Credit For 2020 By Car Model

Electric Vehicles Tax Credit For 2020 By Car Model

Electric Vehicle Tax Credit What To Know For 2020 Clark Howard

Electric Vehicle Tax Credit What To Know For 2020 Clark Howard

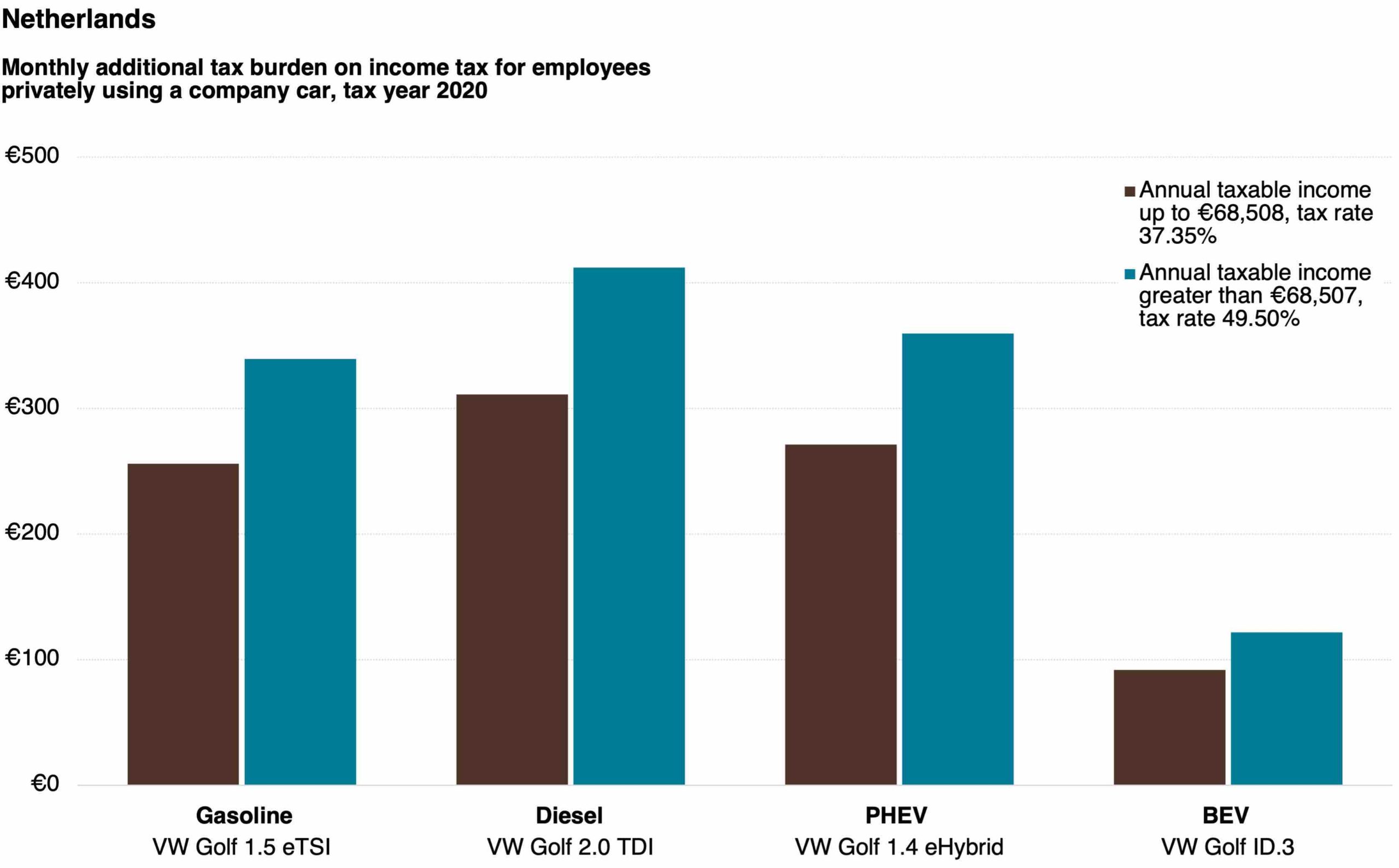

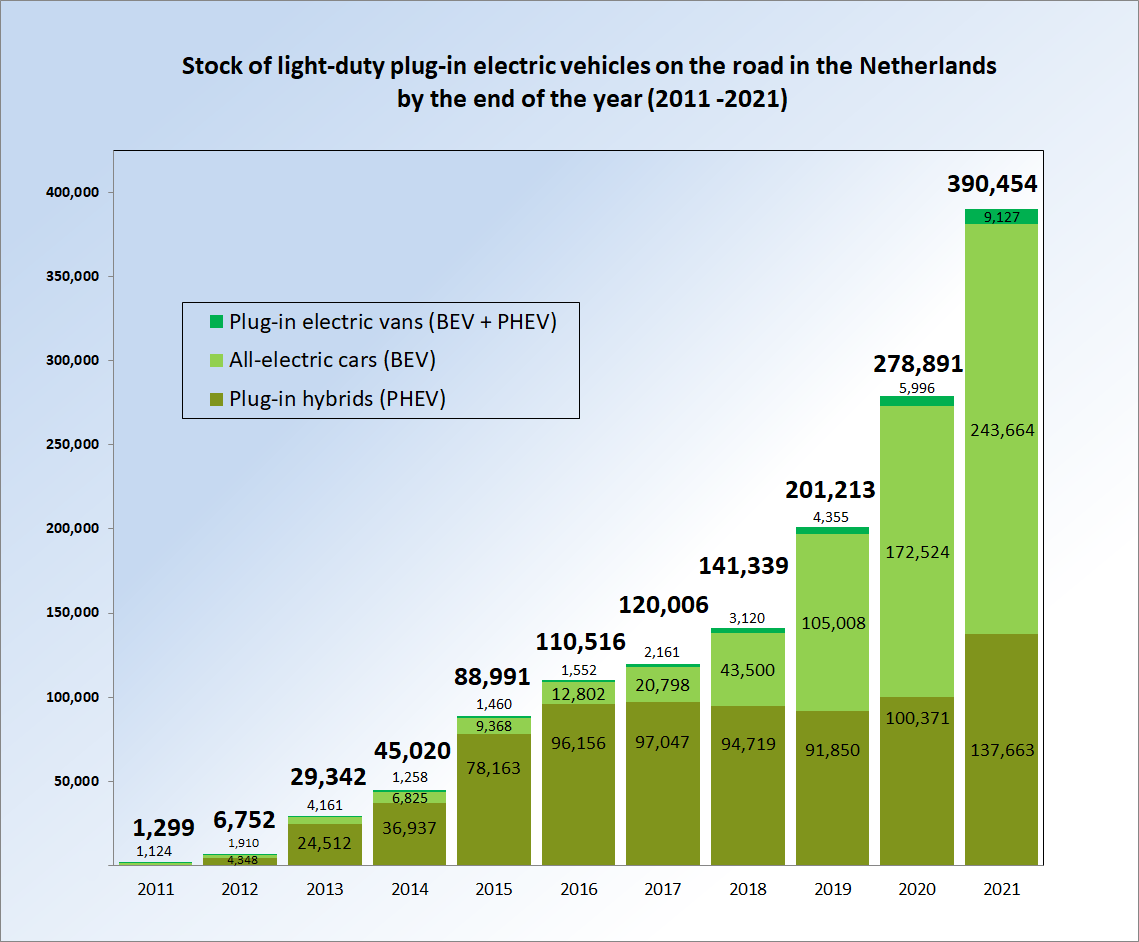

Plug In Electric Vehicles In The Netherlands Wikipedia

Plug In Electric Vehicles In The Netherlands Wikipedia

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption

A Guide To Company Car Tax For Electric Cars Clm

A Guide To Company Car Tax For Electric Cars Clm

Phev Hybrid Tax Incentives For Ohio Indiana Ev Owners Miami Valley Honda Dealers

Phev Hybrid Tax Incentives For Ohio Indiana Ev Owners Miami Valley Honda Dealers

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

Are The Tax Rebates For Electric And Hybrid Cars Worth It Loans Canada

Are The Tax Rebates For Electric And Hybrid Cars Worth It Loans Canada

How Does The Electric Car Tax Credit Work U S News World Report

How Does The Electric Car Tax Credit Work U S News World Report

The Netherlands Goes For Ev Purchase Subsidies Electrive Com

The Netherlands Goes For Ev Purchase Subsidies Electrive Com

Plug In Electric Vehicles In The Netherlands Wikipedia

Plug In Electric Vehicles In The Netherlands Wikipedia

Incentives To Buy An Electric Car Greencars

Incentives To Buy An Electric Car Greencars

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Mueller

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Mueller

Comments

Post a Comment