- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

The new pay scale Effective 01012021 showing the bi-weekly salary for all grades and steps will be updated and posted on the website. Paydays can be less frequent for executive administrative or professional employees.

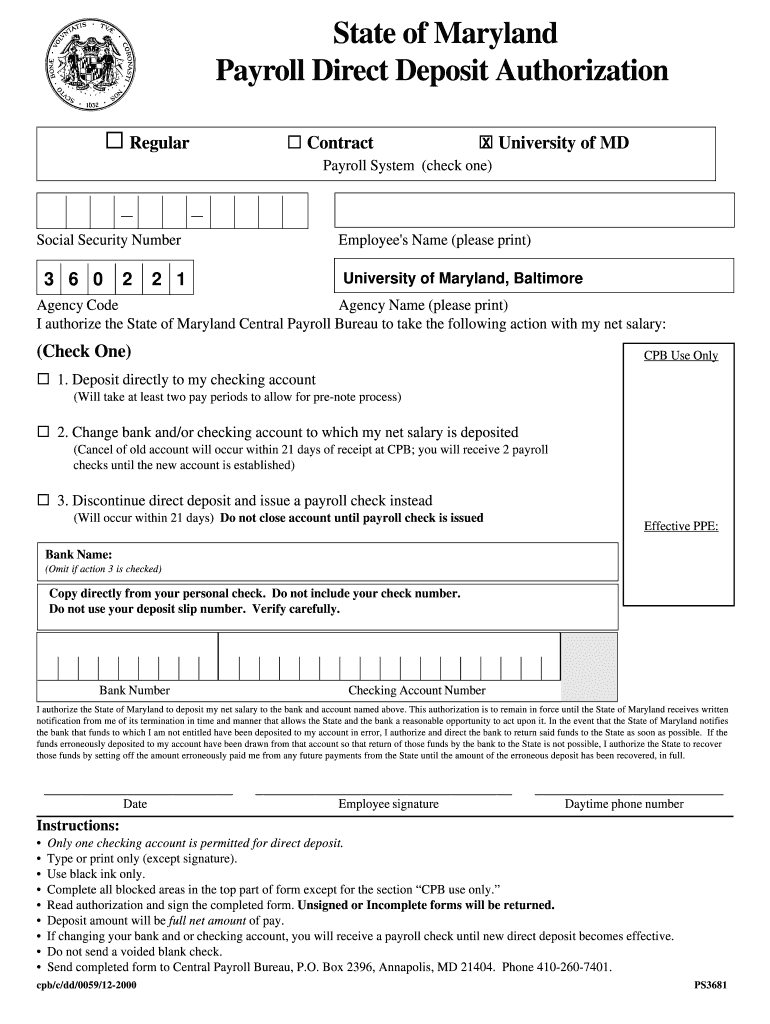

State Of Maryland Direct Deposit Form Fill Online Printable Fillable Blank Pdffiller

State Of Maryland Direct Deposit Form Fill Online Printable Fillable Blank Pdffiller

A link for Feedback Suggestions will be provided after successful logon.

Md state employee payroll. ANNAPOLIS MDGovernor Larry Hogan today announced that the State of Maryland will offer a 100 financial incentive to state employees who elect to receive the COVID-19 vaccine. STATE OF MARYLAND STANDARD SALARY STRUCTURE FISCAL YEAR 2020 For Graded State Employees effective January 1 2020. The Office of the Maryland Comptroller has rounded the salaries and gross pays to the nearest thousand to prevent tax fraud attempts on state employees.

Pay Date Advanced Due to Holiday ETRs must be agency approved by 300 pm. Biweekly rates for all SPS employees those using time entry via Workday. Careers with the State of Maryland.

Plus employees also have to take local income taxes into consideration. Earlier approvals are encouraged. Welcome to the SPS for Employees page.

Maryland Payroll for Employers Generally employers covered by Marylands wage payment law must pay wages no less frequently than biweekly or semimonthly. 101 Zeilen Office of the State Comptroller. 2019 Maryland state salaries download as CSV file.

Central Payroll Bureau Payroll Online Service Center POSC Maryland Supplemental Retirement Plans. On Thursday after PPE unless advanced due to holiday scheduling. As a result some figures have been rounded down to zero.

If the records are voluminous please contact us for an alternative examination method. View of prior year-end pay stubs. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay Calculator available.

11 Zeilen Special Payments Payroll Authorization form. For Graded State Employees effective January 1 2021 Upper figure is ANNUAL salary - Lower figure is BIWEEKLY salary NOTE. Update your direct deposit information.

Collective Bargaining in Maryland. Depending on your agency institution or type of employment you will use the SPS for certain services. If the records cannot be submitted provide the Maryland address and telephone number of the location where original records are available.

For assistance with POSC please email POSCHELPmarylandtaxesgov. If you have forgotten your LogonID or Password please use the Recover LogonID Reset Forgotten Password process. Payroll records of individual employees including payroll journals and copies of filed Maryland employers withholding.

Payroll is easily reported online with our secure Employer Payroll Data. As a State Employee you have the ability to view your own information in Workday. View.

The SPS provides Human Resources Time and Payroll and Employee Benefits services to State employees. View of current pay stubs. Most employees are paid in the Standard Salary Schedule which has 26 grades and 20 steps.

For concerns not addressed in a specific Help Topic use General Help. With this incentive program we are further encouraging state employees to get vaccinated to help keep themselves their families and their communities healthy and safe said Governor Hogan. Tax rates range from 2 to 575.

Health deductions are not taken for Biweekly employees ETRs must be approved 1 day early due to holiday. Net Pay Calculator Selection. State Employees Credit Union - SECU Loan Repayment Program.

Step-by-Step MSRP Sign up Form Retirement Estimator State Retirement and Pension System. The State Salary Plan lists the job title class code salary and other attributes for job classifications within the State Personnel Management System as of January 1 2021. Please answer the questions below so that you can be redirected to.

Each county in Maryland charges a different rate and they range from 25 to 32. Copies of filed use tax returns. When you think of Maryland income taxes think progressive.

Each participating employer is required to certify and submit payroll information electronically at the end of each pay period in accordance with Code of Maryland Regulations COMAR 22040101. If a regular payday falls on a non-workday wages must be paid on the preceding workday. The net pay calculator can be used for estimating taxes and net pay.

Update your address information. Eligible Regular System employees certified to receive the January 1 2021 COLA Pay Adjustment will see partial increase included in the Pay Period that ends 011221 with a pay date check date of 01202021. POSC Payroll Online Service Center - This application provides employees with the following online payroll related services.

Menu Home Search Browse Help Search Back Contact Us Support Signin Knowledge Base Home Search Browse Help Home Browse Client Write Up Cwu States Cwu Maryland 11235 Md Employer Withholding Setup Cwu 11235 Md

Baltimore Sun Public Salary Records

Baltimore Sun Public Salary Records

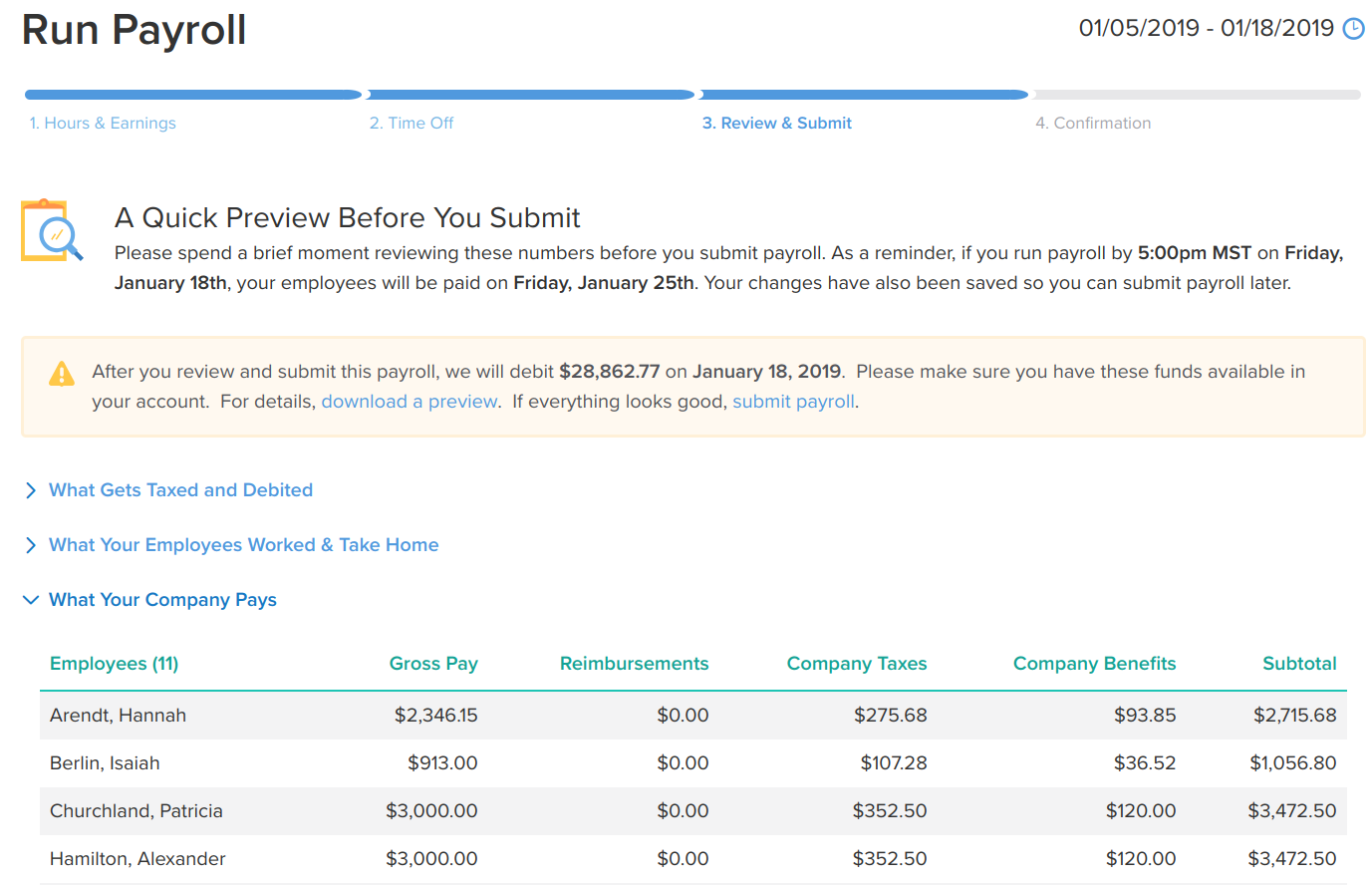

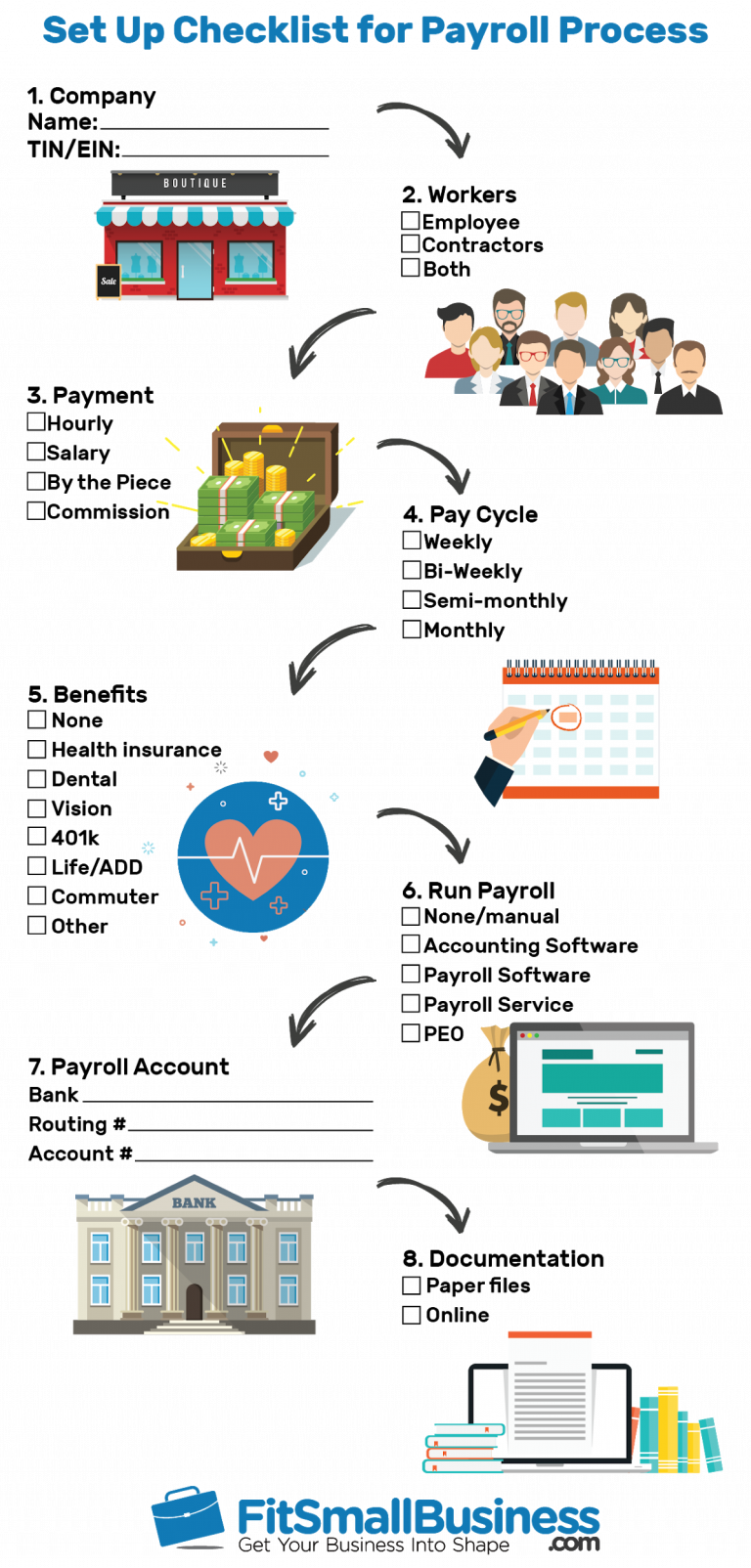

How To Do Payroll In Maryland In 5 Steps

How To Do Payroll In Maryland In 5 Steps

Https Www Courts State Md Us Sites Default Files Import Hr Pdfs Fy21regularschedule Pdf

Https Www Treasurer State Md Us Media 77412 Reissued Payroll Check Pick Up Policy Pdf

Http Mdcourts Gov Hr Forms Brochures Benefits Pdf

How To Do Payroll In Maryland In 5 Steps

How To Do Payroll In Maryland In 5 Steps

New Employee Payroll Forms Advanced Payroll Solutions

New Employee Payroll Forms Advanced Payroll Solutions

How To Do Payroll In Maryland In 5 Steps

How To Do Payroll In Maryland In 5 Steps

Https Www Marylandtaxes Gov Statepayroll Static Files 2020 Memos Payroll Changes Effective January 1 2020 Pdf

Comments

Post a Comment