- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

There are three types of tax breaks. However each state specifies its own rates for income unemployment and other taxes.

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png) Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

Below is a state-by-state map showing tax rates including supplemental taxes and workers compensation.

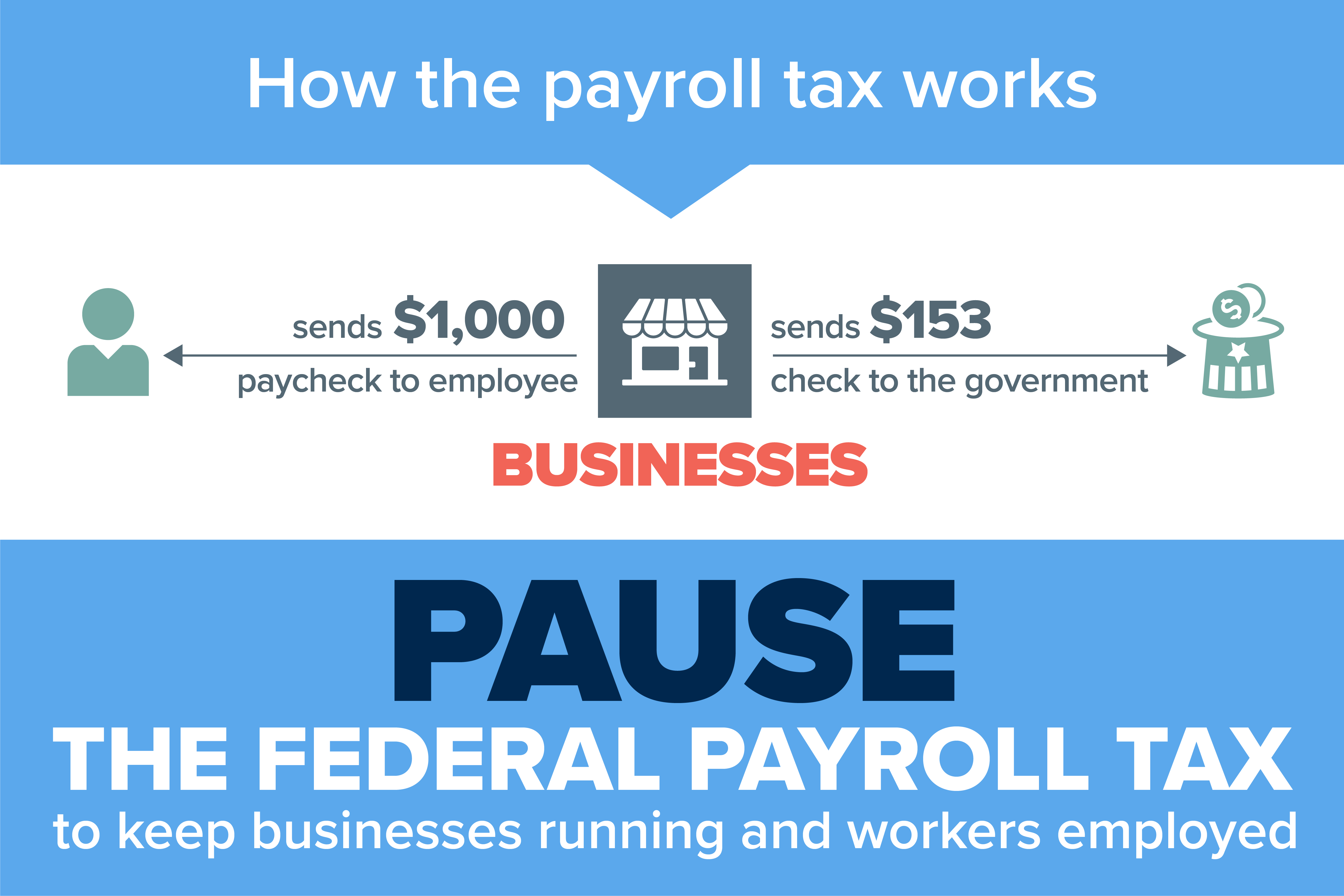

Payroll tax break. During this period certain employees will not have to pay a payroll tax which is 62 for Social. The goal of offering a payroll tax break is to give workers a larger paycheck thereby allowing them to pump more money into an economy thats stuck in a. It must pay 50 by December 31 2021 and the remaining 50 by December 31 2022.

As part of one of the numerous pandemic-related stimulus bills passed by Congress in March the Payroll Tax Credit otherwise known as the Employee Retention Credit is a way to receive funding from the government. Federal payroll tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each are set by the IRS. Workers who benefit will receive a.

Heres how to handle it. A payroll tax cut would reduce the amount taken out of workers paychecks to fund federal programs including Social Security and Medicare. However if an employer was eligible to defer 20000 for the payroll tax deferral period but it paid 15000 of the 20000 and deferred 5000 for the payroll tax deferral period the employer does not need to pay any additional amount by December 31 2021 since 50 of the eligible deferred amount or 10000 has already been paid and is first applied against the employers amount due on.

Eligible businesses must have been impacted by COVID-19 between March 12 2020 and January 1 2021. This is a temporary payroll tax cut that will last from September 1 2020 until December 31 2020. A new Trump tax cut will have to be paid back early next year.

One of the executive orders actually an executive memorandum suspends the collection of Social Security payroll taxes from September 1 until the end of the year for workers making less than. This payroll tax deferral option is available to all employers without any requirement to show a COVID-19 related impact. A payroll tax is a percentage withheld from an employees pay by an employer who pays it to the government on the employees behalf.

The CAA did not extend this deferral. A business is required to pay the deferred payroll tax amount in two installments. There has been a lot of buzz about President Trumps payroll tax cut or holiday from now to the end of the year.

Congress would have to decide how much. A tax break is a reduction of a taxpayers total tax liability. Trump proposes payroll tax break extension of unemployment benefits At a press conference President Donald Trump criticized Democrats.

One of the executive orders actually an executive memorandum suspends the collection of Social Security payroll taxes from September 1 until the end of the year for workers making less than. A tax deduction reduces the amount of. A tax deduction a tax credit and a tax exemption.

What Is a Payroll Tax. It could mean another 6 percent of your income back in your pocket giving you. A payroll tax cut halts the collection of certain wage-based taxes typically those collected for Social Security and Medicare.

Second Stimulus A Payroll Tax Break Youtube

Second Stimulus A Payroll Tax Break Youtube

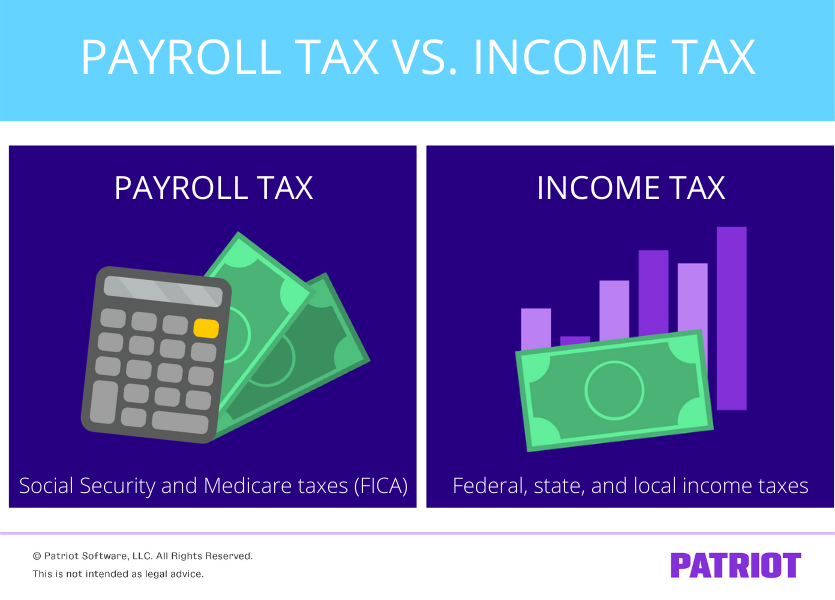

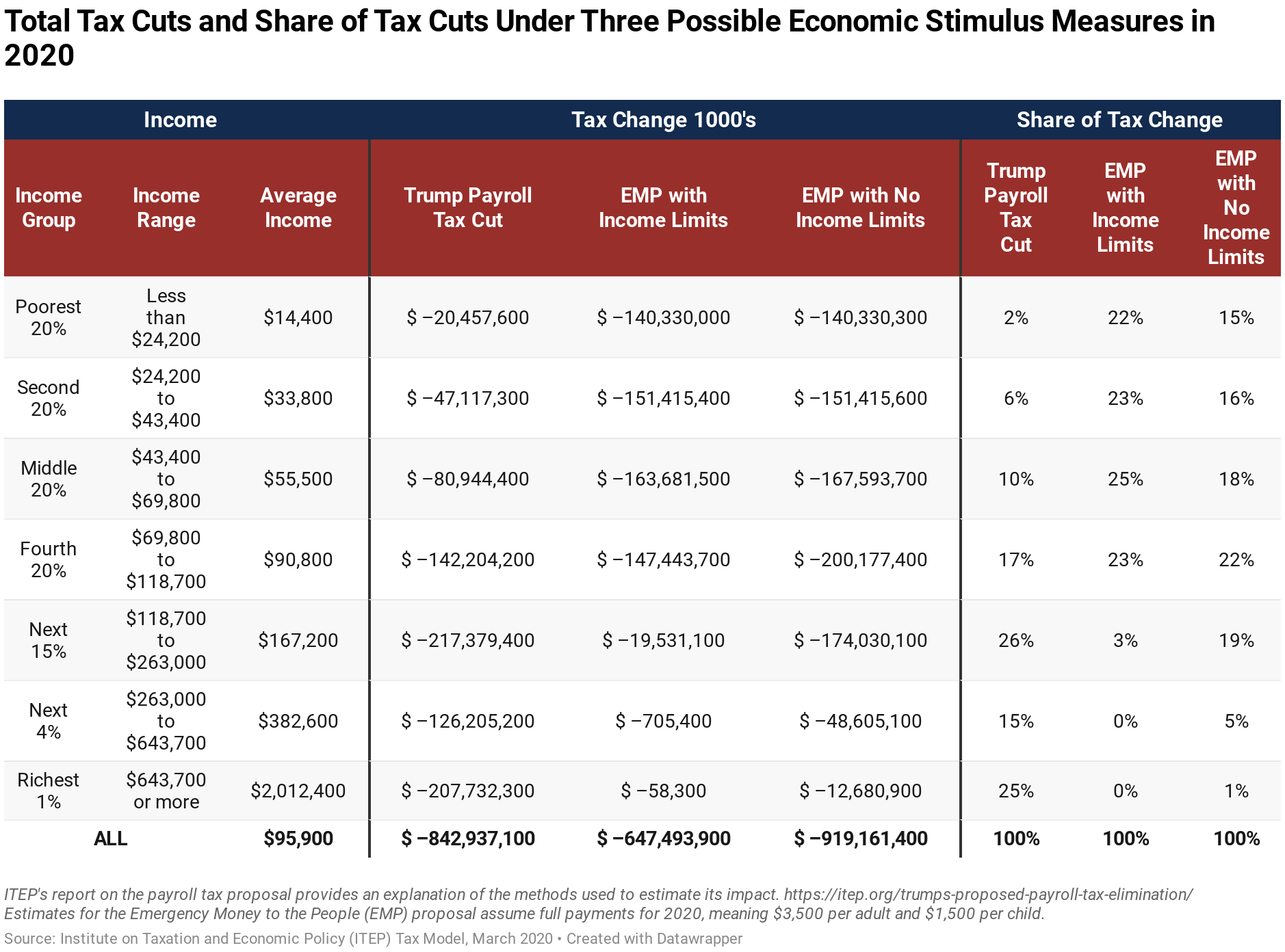

Trump S Proposed Payroll Tax Elimination Itep

Trump S Proposed Payroll Tax Elimination Itep

White House Considers Payroll Tax Cut That Gop Opposed During Obama Years Itep

White House Considers Payroll Tax Cut That Gop Opposed During Obama Years Itep

How Are Payroll Taxes Different From Personal Income Taxes

How Are Payroll Taxes Different From Personal Income Taxes

Opinion Trump S Payroll Tax Holiday Would Mostly Benefit The Rich While Sabotaging Medicare And Social Security

Opinion Trump S Payroll Tax Holiday Would Mostly Benefit The Rich While Sabotaging Medicare And Social Security

Payroll Tax Cut Here S What That Might Mean For Us Businesses Cnnpolitics

Payroll Tax Cut Here S What That Might Mean For Us Businesses Cnnpolitics

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

Payroll Tax Deferral Starts Today

Payroll Tax Deferral Starts Today

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Checks To All Vs Trump S Payroll Tax Cut Itep

Checks To All Vs Trump S Payroll Tax Cut Itep

Checks To All Vs Trump S Payroll Tax Cut Itep

Checks To All Vs Trump S Payroll Tax Cut Itep

Trump S Proposed Payroll Tax Elimination Itep

Trump S Proposed Payroll Tax Elimination Itep

Comments

Post a Comment