- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Forms by Tax Type. Founded in 1996 by sales and use tax expert Diane Yetter the Sales Tax Institute has been helping tax finance and accounting professionals learn about the varied and nuanced world of sales and use tax.

Money Math Solve Sales Tax Word Problems Worksheet Education Com Money Math Money Worksheets Word Problem Worksheets

Money Math Solve Sales Tax Word Problems Worksheet Education Com Money Math Money Worksheets Word Problem Worksheets

Tax Education.

Sales tax education. You must register for each states tax system individually. Sales of live in-person educational services are not taxable Sales of live digital online educational services are not taxable Sales of digital books and videos and tangible books and videos are generally taxable Sales of pre-recorded seminars and webinars downloaded or streamed are. This course is an introduction to sales and use taxes in Minnesota.

The Sales Tax Institute is registered with the National Association of State Boards of Accountancy NASBA as a sponsor of continuing professional education on the National Registry of CPE Sponsors. Sales Use Tax Training Courses If you have questions about sales and use tax laws youre not alone. Register for a sales tax permit in that state.

11 rijen Course Description. Advertentie Streamline Automate Sales Tax Filing In Multiple Countries. The Institute provides sales tax professionals with connections to their tax peers through education and certification programs networking chat rooms and member directories.

Advertentie Streamline Automate Sales Tax Filing In Multiple Countries. Sales Use Tax. Sales taxes are deductible but there are limitations.

As of 2013 25 percent of state money went to K though 12 education 16 percent paid for childrens health insurance and Medicaid and higher education received 13 percent. The Sales Tax Institute is your destination for any sales and use tax training and education along with assistance in career development for sales tax professionals. The major requirements for the Sales Tax Professional Designation include membership in the Institute sales and use excise andor gross receipts tax experience successful completion of the IPT sales tax schools other educational requirements and successful completion of both comprehensive written and oral examinations.

To calculate sales tax follow these steps. Sales tax education training and professional development opportunities available with the Sales Tax Institute can help you succeed no matter your experience with sales and use tax. Forms in Number Order.

After youve determined that you actually have nexus in a state and need to get involved with sales tax the process is surprisingly straightforward. Online educational content is exempt from North Carolina sales tax Jun 8 2020 Gail Cole The evolution of sales tax on digital goods and services in North Carolina hit a new milestone on June 5 2020 when a measure exempting digital educational content from. There are 7500 different taxing jurisdictions in the United States alone and they routinely tax the same products differently.

These limits are for taxes due by May 17 2021 the IRSs extended deadline to file individual tax returns for 2020. According to the Wisconsin Department of Revenue thats because the seller is not performing an educational service. Your deduction of state and local income taxes sales taxes and property taxes is capped at 10000 5000 if married filing separately.

In Wisconsin buyers of educational products pay sales tax on things like books CDs DVDs and videotapes unless theyre tax exempt. State sales taxes play a major role in supporting education and health care because more than half of state funds go to support these needs according to the Center on Budget and Policy Priorities. Its easy to understand why our sales and use tax laws are considered among the most complicated in the world.

Turn the sales tax. Sales Tax Education Course Catalog. Registration and program brochures are available 90.

If you are a novitiate in your sales tax career or have been doing it for years our programs have something for you. For example if you live in California your sales tax is 75. The sales tax limit for tax year 2020 is 10000 or 5000 if youre married and filing separately.

Sales. Find out how much the sales tax is in your state. Tax Policy.

This limit includes property and sales tax combined. Here are three simple steps for complying with US sales tax for online courses. State boards of accountancy have final authority on.

Report Tax Evasion. Classes are available in many different delivery methods to be most convenient for you and many classes provide CPE credits.

Penny Sales Tax Opponents File Oklahoma Supreme Court Challenge Kgou

Penny Sales Tax Opponents File Oklahoma Supreme Court Challenge Kgou

Sales Tax Anchor Chart Anchor Charts Education Poster 7th Grade Math

Sales Tax Anchor Chart Anchor Charts Education Poster 7th Grade Math

What Funds Education In Nevada Mostly Sales Tax Nevada Current

What Funds Education In Nevada Mostly Sales Tax Nevada Current

Teaching Kids About Sales Tax Accuratetax Com

Teaching Kids About Sales Tax Accuratetax Com

Calculating Sales Tax Worksheet Education Com

Calculating Sales Tax Worksheet Education Com

Back To School Sale Tax Holiday Alabama Retail Association

Back To School Sale Tax Holiday Alabama Retail Association

Back To School Sales Tax Holiday City Of Foley

Back To School Sales Tax Holiday City Of Foley

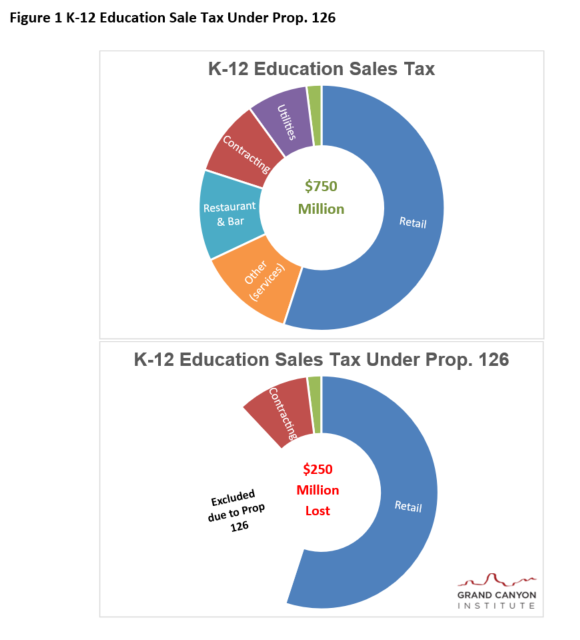

Sales Tax Increase For Arizona Schools Has A Major Flaw Higher Ed

Sales Tax Increase For Arizona Schools Has A Major Flaw Higher Ed

Consequences Of Prop 126 250 Million Cut To Education Future Cuts To Transportation Funding And Higher Taxes On Goods Grand Canyon Institute

Consequences Of Prop 126 250 Million Cut To Education Future Cuts To Transportation Funding And Higher Taxes On Goods Grand Canyon Institute

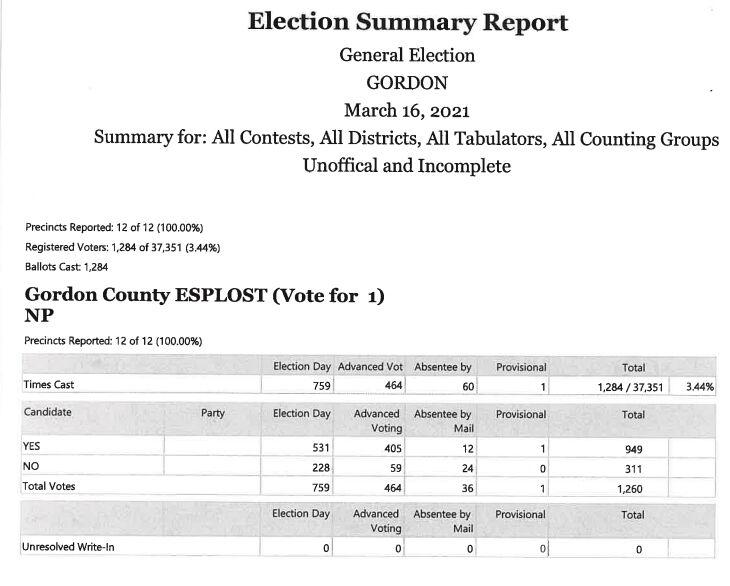

Gordon County Voters Pass Education Sales Tax Education Northwestgeorgianews Com

Gordon County Voters Pass Education Sales Tax Education Northwestgeorgianews Com

Sales Tax And Vat For E Commerce Tips To Stay Compliant

Sales Tax And Vat For E Commerce Tips To Stay Compliant

Calculate Sales Tax Worksheet Education Com

Calculate Sales Tax Worksheet Education Com

Sales And Use Tax Training Sales Tax Institute

Sales And Use Tax Training Sales Tax Institute

Sales Tax Training Sales Tax Courses Online Classes And Resources Sales Tax Institute

Sales Tax Training Sales Tax Courses Online Classes And Resources Sales Tax Institute

Comments

Post a Comment