- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Here are the three proposed tax brackets and rates from Trumps website. The bill signed into law by Trump on 22 December 2017 cut the corporate tax rate from 35 to 21 the largest such rate cut in US history.

The Two Biggest Lies In Donald Trump S Tax Plan The American Prospect

The Two Biggest Lies In Donald Trump S Tax Plan The American Prospect

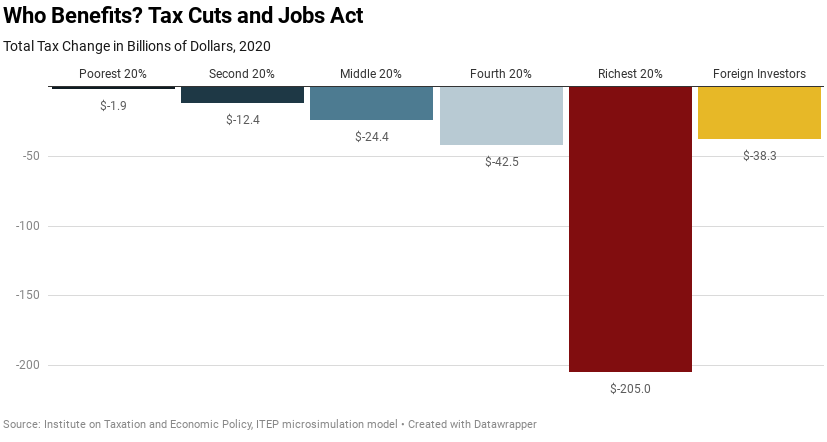

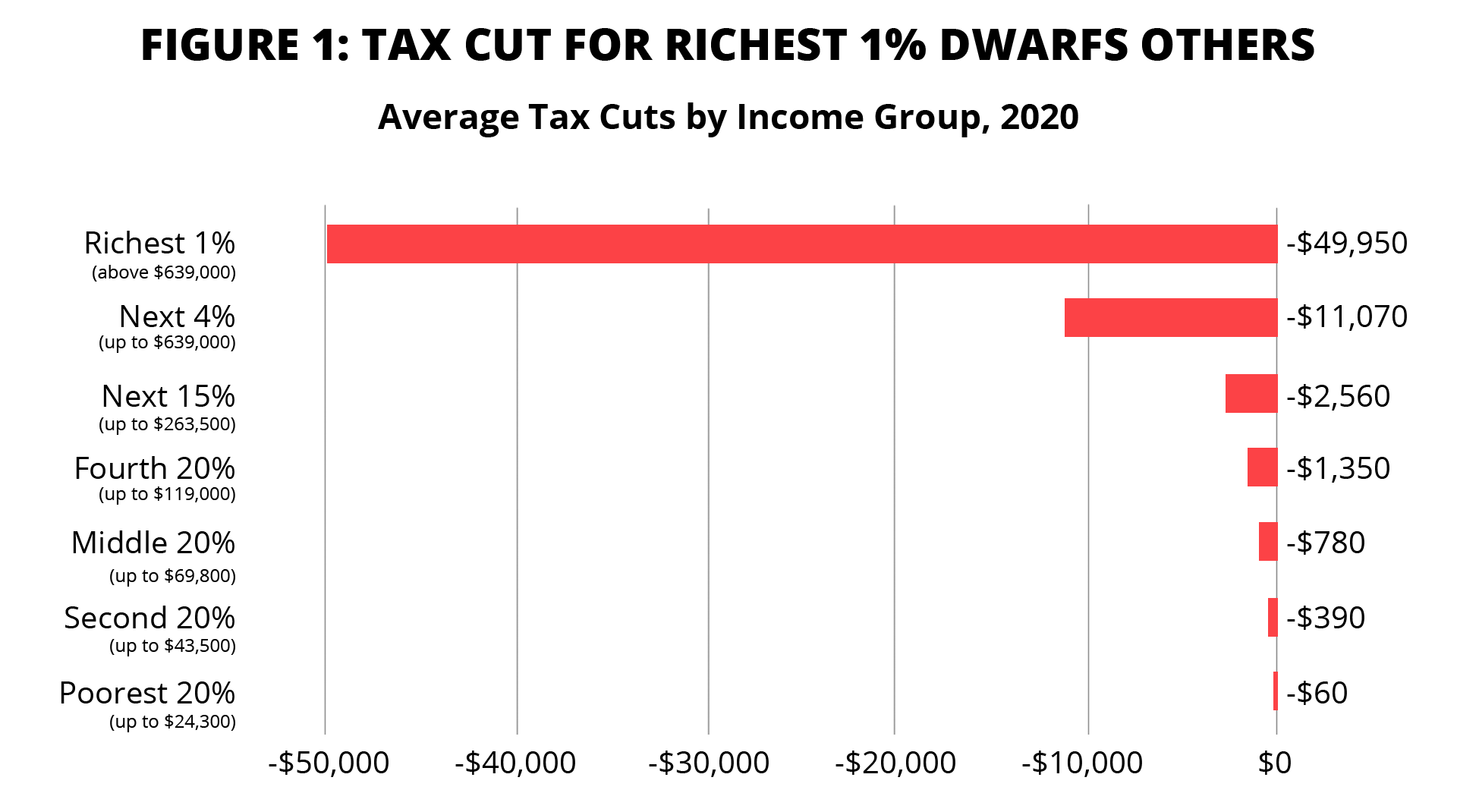

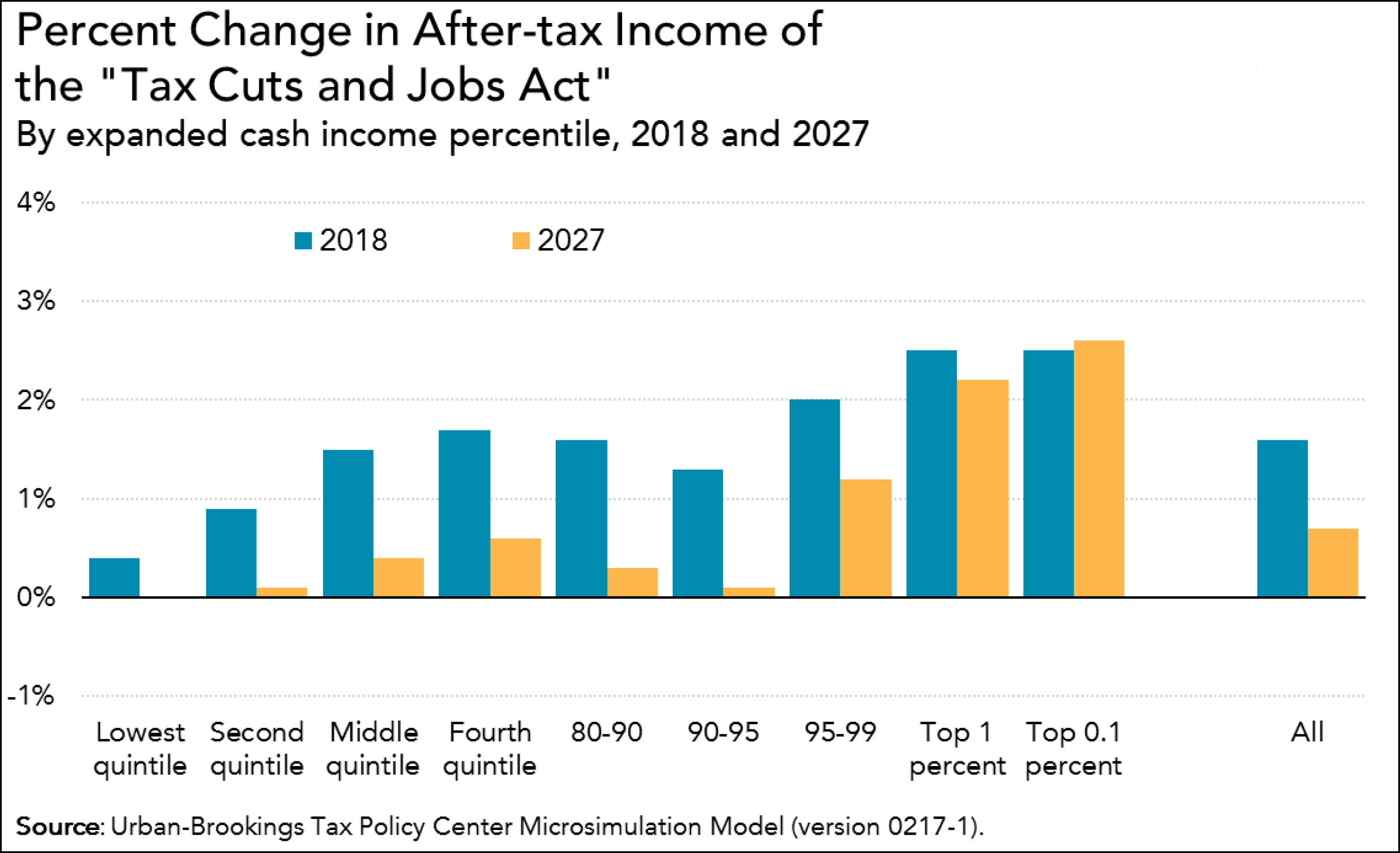

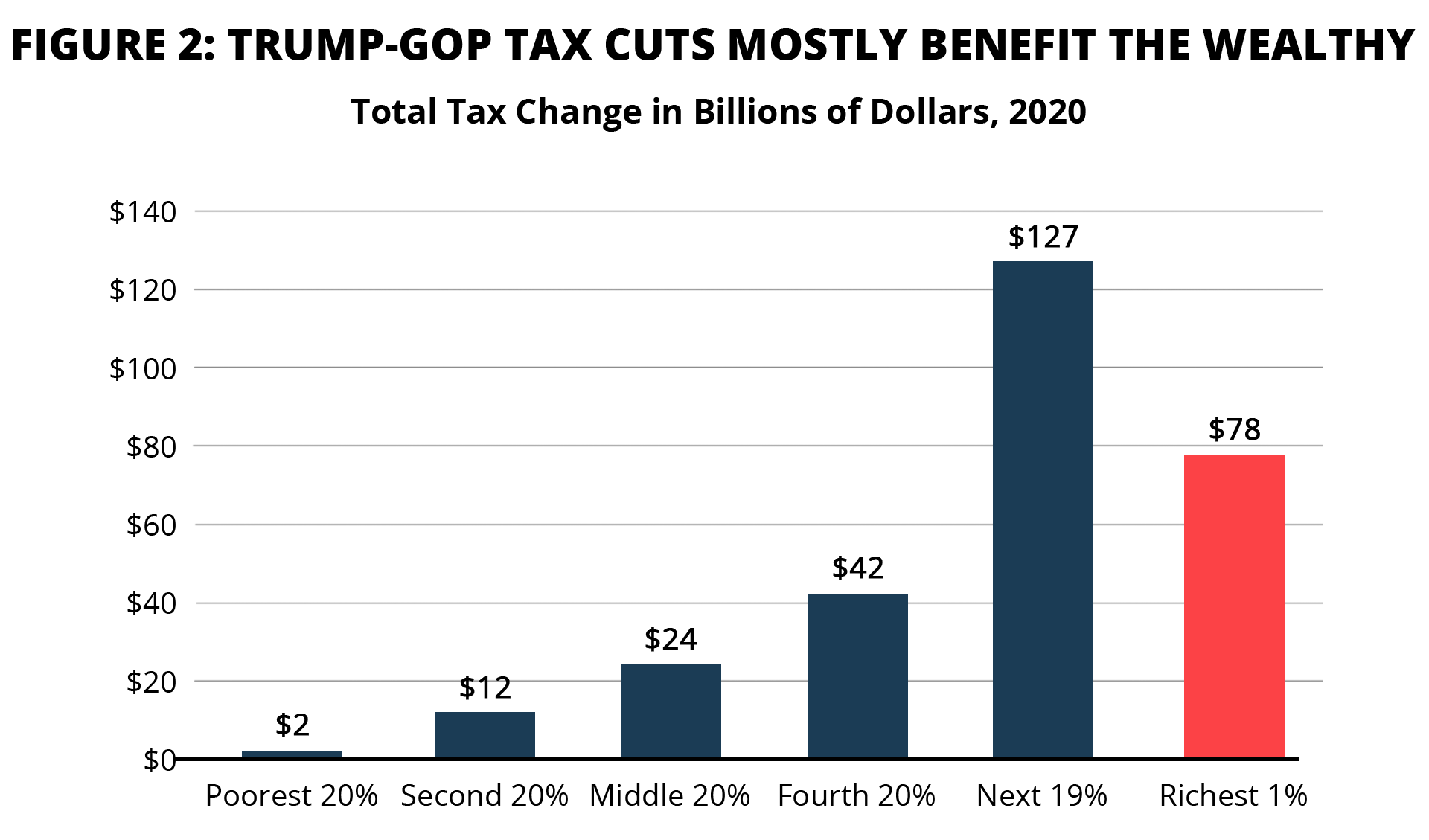

Under the Trump tax law the first groups annual income taxes declined on average by 143 while the second groups tax reduction averaged 17800.

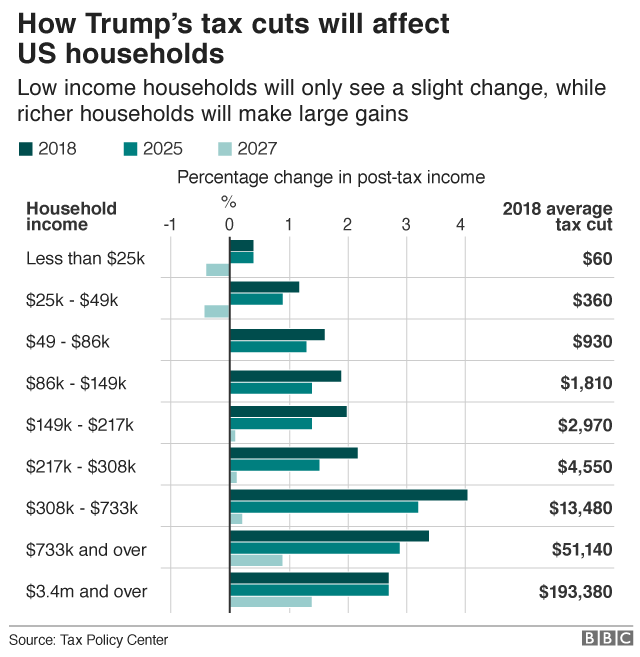

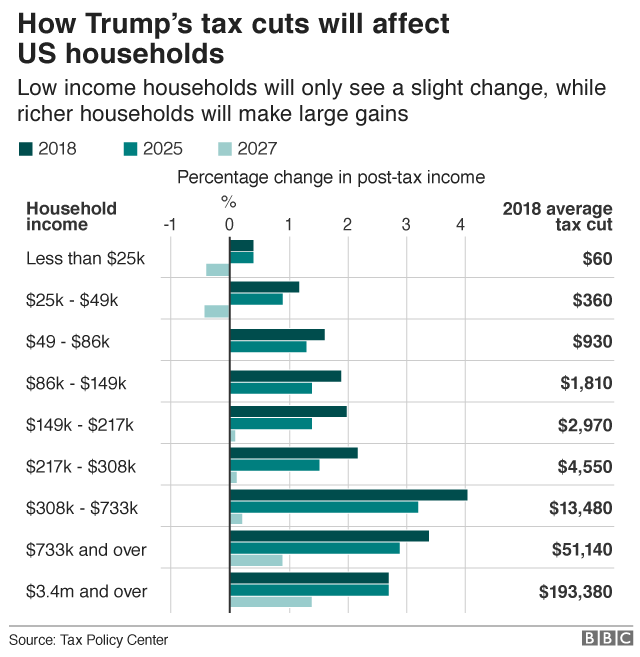

How much was trump's tax cut. 12 More than 75000 but less than 225000. In 2025 according to the Tax Policy Center the top 1 would get 25 of the cut. The 2017 tax cut reduced the top corporate tax rate from 35 percent to 21 percenta 40 percent reduction.

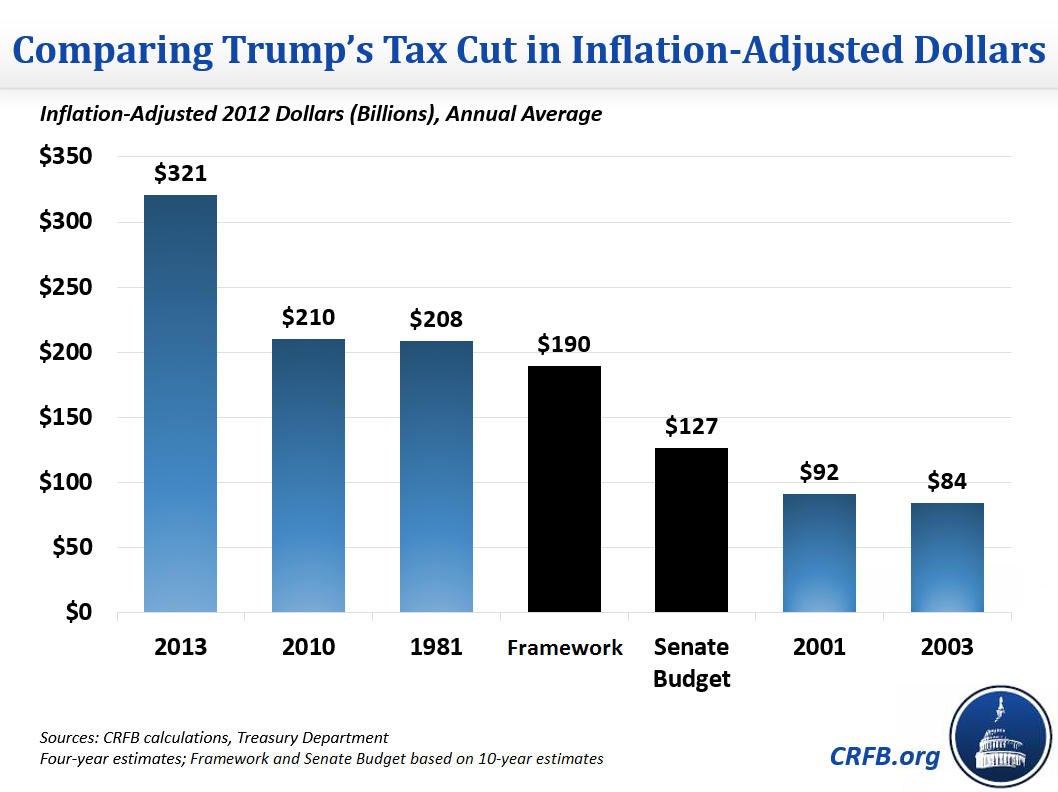

While Americans are getting tax cuts depending on individual taxpayer circumstances the Joint Committee on Taxation and the Congressional Budget Office said in 2017 that Trumps tax plan could add over 1 trillion by 2027 to the national debt. In 1960 the 400 richest families paid as much as 56 in taxes by 1980 the rate had fallen to 40. Since Trumps tax cut is much less than 55 trillion it is not the largest and fails to make it into the top 10 largest tax cuts.

The union said that despite the billions in dollars of tax savings at ATT workers had yet to see the 4000 raise that White House officials said would result from the tax cut. It also reduced income taxes for most Americans. The most excited group out there are big CEOs said.

Tax landscape for the first time in decades. Brackets Rates for Married-Joint filers. The 2017 tax cuts dramatically alter the US.

It offered a permanent reduction in tax rates for corporations to a top rate of 21 from 35. But Trumps tax cuts his most significant legislative victory proved a tipping point. Trumps proposed tax plan would reduce the number of tax brackets from seven to three with the highest rate set at 33 for married filers earning more than 225000.

The standard deduction was doubled from 6000 to. Between new cost estimates and the White Houses own budget numbers the wheels are coming off Republican claims that. But the rise for the seven months after the tax cut was 67 percent.

In June 2017 CBO anticipated a deficit of 36 of GDP for 2020. Democratic presidential nominee Joe Biden often talks about repealing President Trumps tax cuts for the wealthy claiming in a recent town hall that about 13 trillion of the 2. Thats still a lot.

This is an 114 decline since last year which averaged 2860. If Congress does nothing to extend them the top 1 will at that point receive roughly 83 of the tax cut benefits according to estimates from the nonpartisan Tax Policy Center. The Tax Cuts and Jobs Act gave temporary tax breaks to individuals.

During the 2020 presidential campaign then-Vice President Joe Biden vowed to roll back the tax cuts passed by Republicans and signed by President Donald Trump. At 23 trillion cost Trump tax cuts leave big gap. Tax reform doubled the child tax credit from 1000 to 2000 giving over 22 million American families important tax relief.

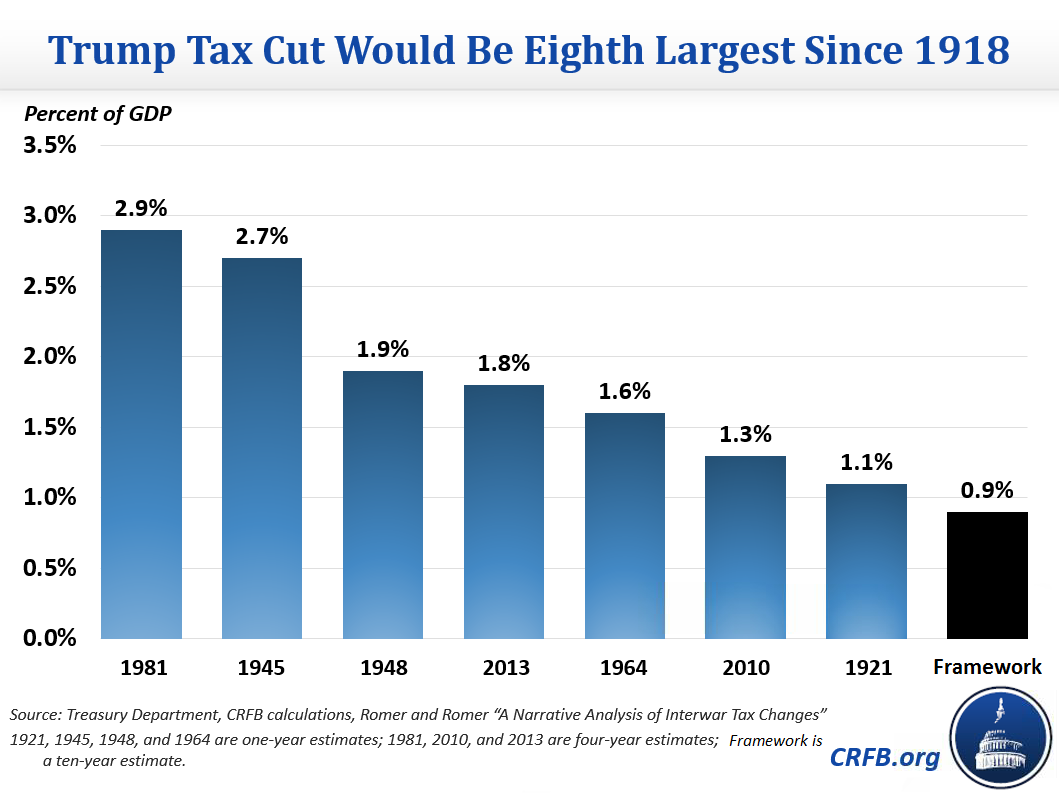

The largest tax cut ever in American history occurred in 1981. This is a much worse outlook for the current deficit than CBO showed just before Congress passed the Trump tax cuts. Tax-to-GDP ratio falls 25 from 2017 to 2018 the OECD finds.

Thanks to Trumps tax cuts the US. And if you look at total tax collections from every category rather than just individual income taxes the picture is even. A fairer benchmark is what would happen to taxes while the Trump cuts are still in place.

Republican politicians such as Paul Ryan have advocated for spending cuts to help finance the tax cuts while the President Trumps 2018 budget includes 21 trillion in spending cuts over ten years to Medicaid Affordable Care Act subsidies food stamps Social Security Disability Insurance Supplemental Security Income and cash welfare.

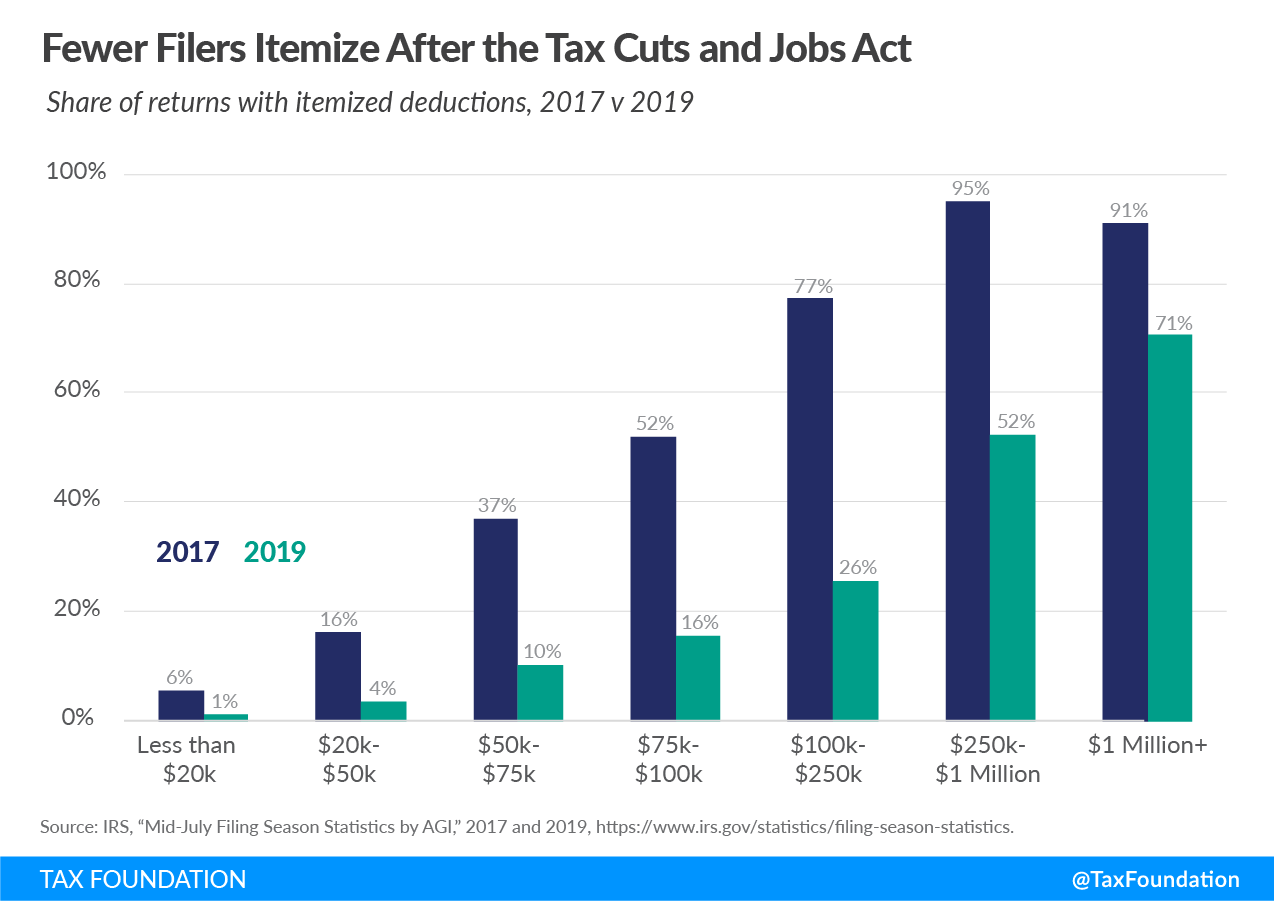

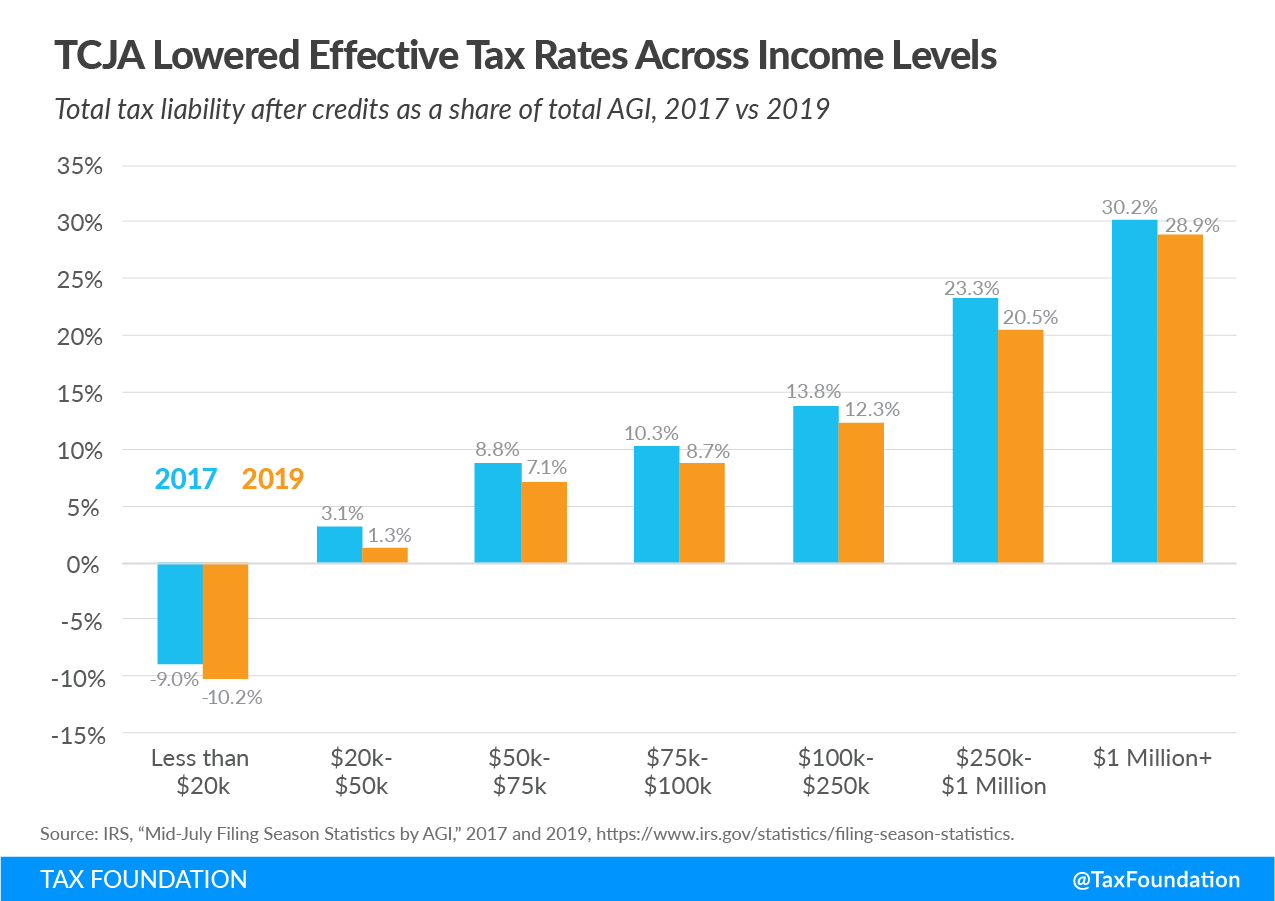

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Updated Estimates From Itep Trump Tax Law Still Benefits The Rich No Matter How You Look At It Itep

Updated Estimates From Itep Trump Tax Law Still Benefits The Rich No Matter How You Look At It Itep

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

Opinion You Know Who The Tax Cuts Helped Rich People The New York Times

Opinion You Know Who The Tax Cuts Helped Rich People The New York Times

Are President Trump S Tax Cuts Helping Workers Bbc News

Are President Trump S Tax Cuts Helping Workers Bbc News

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Is President Trump S Tax Cut The Largest In History Yet Committee For A Responsible Federal Budget

Is President Trump S Tax Cut The Largest In History Yet Committee For A Responsible Federal Budget

Trump S Rumored Tax Cuts 2 0 Proposals Aren T Focused On The Middle Class Center For American Progress

Trump S Rumored Tax Cuts 2 0 Proposals Aren T Focused On The Middle Class Center For American Progress

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

The Trump Tax Cut Did Bubkes For The Working Class Mother Jones

The Trump Tax Cut Did Bubkes For The Working Class Mother Jones

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Federal Tax Cuts In The Bush Obama And Trump Years Itep

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

How Would Trump S Tax Cuts Affect Different Taxpayers Tax Policy Center

How Would Trump S Tax Cuts Affect Different Taxpayers Tax Policy Center

Is President Trump S Tax Cut The Largest In History Yet Committee For A Responsible Federal Budget

Is President Trump S Tax Cut The Largest In History Yet Committee For A Responsible Federal Budget

Comments

Post a Comment