- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

See IRA Contribution Limits. The annual contribution limit for 2019 2020 and 2021 is 6000 or 7000 if youre age 50 or older.

Reminder Ira Contribution Deadlines

Reminder Ira Contribution Deadlines

IRA Eligibility and Contribution Limits The contribution limits for both traditional and Roth IRAs are 6000 per year plus a 1000 catch-up contribution for those 50 and older for both tax.

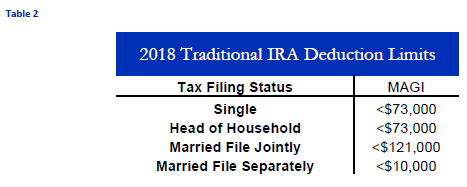

Maximum ira deduction. Roth IRA contributions arent deductible. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income exceeds certain levels. IRA FAQs - Contributions How much can I contribute to an IRA.

More than 66000 but less than 76000. The limit for contributions to Roth and traditional IRAs for the 2020 tax year filed in 2021 is 6000 or 7000 if youre aged 50 or older. 6000 7000 if youre age 50 or older or.

That 6000 or 7000 is the total you can deduct for all contributions to qualified retirement plans in 2020 and 2021. Traditional IRA contributions are not limited by annual income. More than 49500.

This increases to 7000 if youre age 50 or older. Traditional IRA deduction limits Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. If youre a high earner or just a super saver and your employers 401k allows additional contributions above the 19500 tax-deductible limit you may be able to perform the mega backdoor Roth IRA.

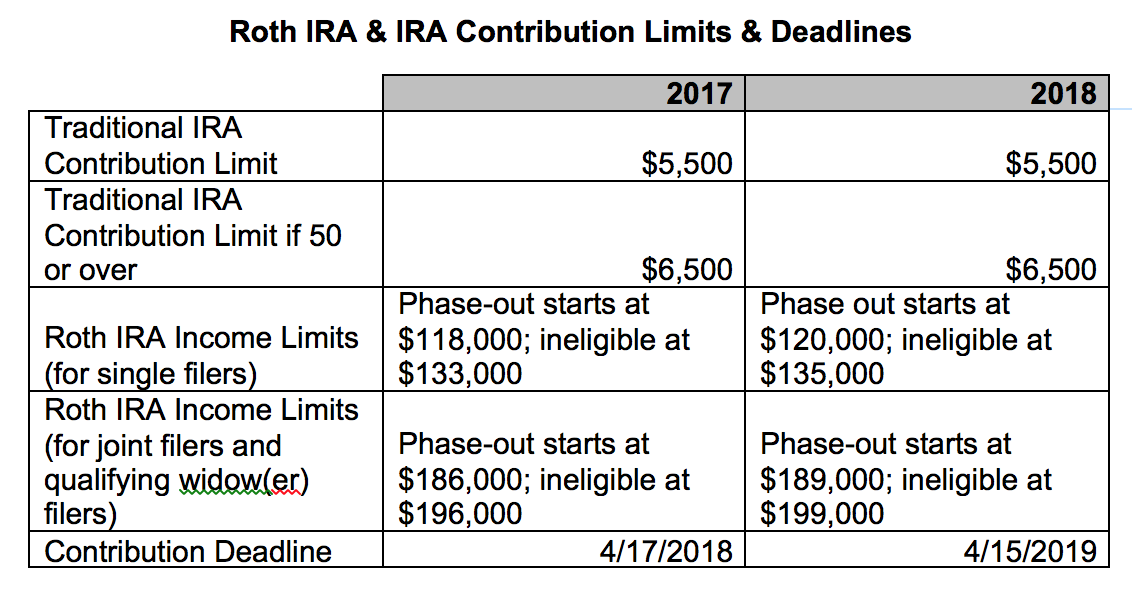

6000 if you are under the age of 50 7000 if you are age 50 or older by the end of the tax year. 6000 for the year. The annual contribution limit for 2015 2016 2017 and 2018 is 5500 or 6500 if youre age 50 or older.

The 2021 IRA Contribution Limit The maximum IRA contrition for 2021 is 6000 the same as in 2020. In 2020 and 2021 you can contribute up to 6000 to a traditional IRA or 7000 if youre 50 or older as long as your taxable compensation is at least that much. Single or head of household.

Retirement savers age 49 and younger can. In order to claim the nonrefundable tax. This non-refundable tax credit is allowed in addition to any deduction you may receive for your IRA contribution.

The 2021 maximum IRA contribution limit will be the same as the 2020 maximum IRA contribution limit. This amount will be the same for the 2021 tax year. The same annual limits apply to IRAs whether they are set up on behalf of a spouse or not.

9 Zeilen a full deduction up to the amount of your contribution limit. The IRS has announced the 2021 maximum IRA contribution limit which is the max you can contribute to your IRAs in a given calendar year. They were 5500 and 6500 for tax years 2015 through 2018.

If less your taxable compensation for the year. You can take an IRA deduction for up to 6000 in contributions in 2021 if youre age 49 or under. Partial contributions are allowed for certain income ranges.

Retirement plan at work. 10 Zeilen a full deduction up to the amount of your contribution limit. Retirement Topics - IRA Contribution Limits.

For the tax year 2021 the MAGI ranges that allow you to deduct somebut not allof your IRA contributions are. 6 These limits can increase annually although they dont always do so. More than 105000 but less than 125000.

Maximum contribution amounts For 2020 you can contribute to a traditional IRA up to. For 2021 2020 and 2019 the total contributions you make each year to all of your traditional IRAs and Roth IRAs cant be more than. Married filing jointly or qualifying widow er.

3 4 Having a 401 k account at work doesnt affect your eligibility to make.

.png?width=500&height=257) 2018 Ira Contribution Limits Atbs

2018 Ira Contribution Limits Atbs

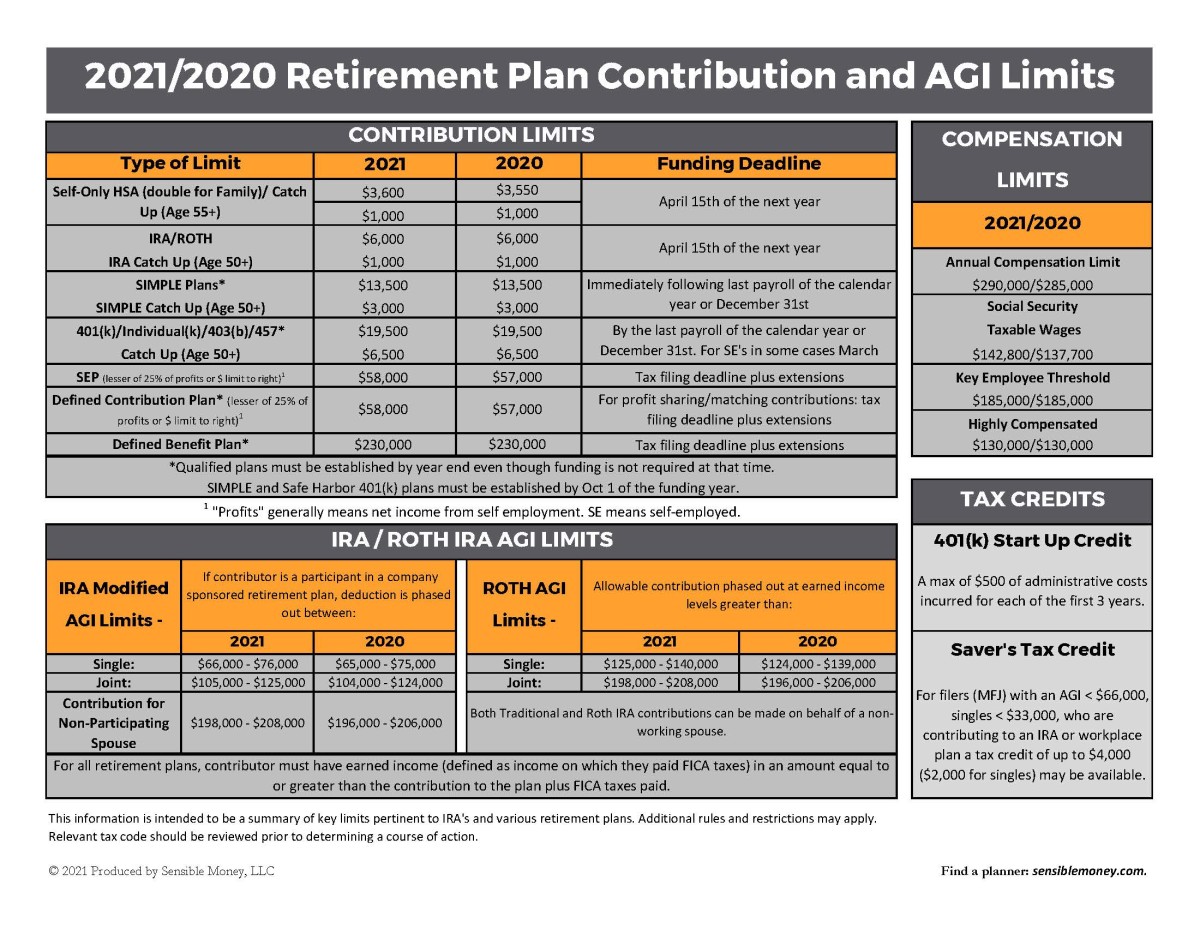

![]() Ira And Retirement Plan Limits For 2021 Pg Co

Ira And Retirement Plan Limits For 2021 Pg Co

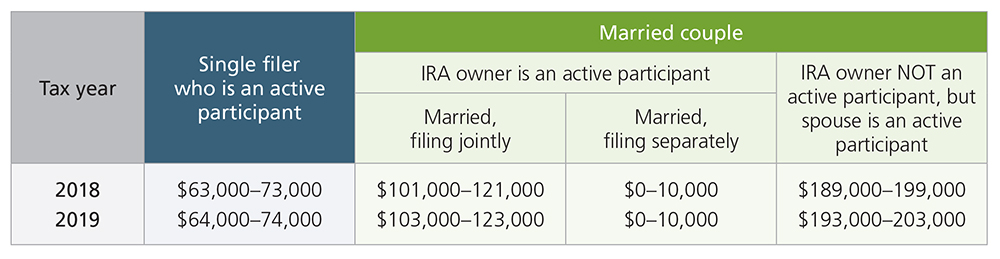

Age And Income Are Determining Factors For Traditional Ira Contributions Ascensus

Age And Income Are Determining Factors For Traditional Ira Contributions Ascensus

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

What Are The 2021 Contribution Limits For Iras 401 K S And Hsas Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

What Are The 2021 Contribution Limits For Iras 401 K S And Hsas Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Contribution Limits Iras And Beyond Quest Trust Company

2021 Contribution Limits Iras And Beyond Quest Trust Company

Most Ira And Retirement Plan Limits Will Increase For 2019 Ascensus

Most Ira And Retirement Plan Limits Will Increase For 2019 Ascensus

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

Comments

Post a Comment