- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

How to Calculate 2020 Maryland State Income Tax by Using State Income Tax Table. New York 882.

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Maryland state tax rate 2020. The credit used to determine the Maryland estate tax cannot exceed 16 of the amount by which the decedents taxable estate exceeds the Maryland estate tax exemption amount for the decedents. Find your income exemptions. Instructions for filing personal income tax returns for nonresident individuals.

It is based on the maximum credit for state death taxes allowable under 2011 of the Internal Revenue Code. Maryland Income Tax Rates and Brackets. 10 on property passing to other individuals.

Pay Period 04 2020. Specifically counties in Maryland collect income taxes with rates ranging from 225 to 320. Taxpayers Filing as Single Married Filing Separately.

Find your pretax deductions including 401K flexible account contributions. State Rates 2020 Rates 2021. In Maryland different tax brackets are applicable to different filing types.

2019 Forms W-2 reminders. The Maryland Comptrollers has released the 2020 state and local income tax withholding percentage and regular methods. South Carolina 700.

2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate Carroll County 1018 2515. Additionally there is a statewide income tax in Maryland with a top rate of 575. 8 Zeilen 2020 Maryland Tax Tables with 2021 Federal income tax rates medicare rate FICA and.

Tax rates for decedents who died on or after July 1 2000. Maryland state and local tax withholding changes for 2020. Maryland state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with MD tax rates of 2 3 4 475 5 525 55 and 575.

State of Maine - Individual Income Tax 2019 Rates. The tax formulas for the State of Maryland include the following changes. Instructions for filing personal state and local income taxes for full- or part-year Maryland residents.

The minimum standard deduction has increased from 1500 to 1550. The maximum standard deduction has increased from 2250 to 2300. 09 tax on the clear value of property passing to a child or other lineal descendant spouse parent or grandparent.

County Municipal property tax rates in effect for July 1 2020 tax bills County Municipal property tax rates in effect for July 1 2019 tax bills County Municipal property tax rates in effect for July 1 2018 tax bills County Municipal property tax rates in effect for July 1 2017 tax. Find your gross income. 8 on property passing to siblings.

The Maryland estate tax is a transfer tax imposed on the transfer of assets from an estate. States for income taxes its state sales tax of 6 is relatively quite low. While those combined state and local taxes place Maryland in the top half of US.

The tax formulas for the following Maryland. Instructions for filing fiduciary income tax returns. 2020 Maryland tax brackets and rates for all four MD filing statuses are shown in the table below.

Check the 2020 Maryland state tax rate and the rules to calculate state income tax. Each tax rate is reported to the Department by local governments each year. Form may be used by resident and nonresident individuals to report income modifications applicable to tax year 2020 that are enacted during the 2021 legislative session including changes from the Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act of 2021 SB496Ch39.

Maryland has eight marginal tax brackets ranging from 2 the lowest Maryland tax bracket to 575 the highest Maryland tax bracket. New Jersey 1075. All chargeable benefits paid to former employees from July 1 2019 to June 30 2020 will not impact your tax rate for 2021.

2020 Individual Income Tax Instruction Booklets. Tax rates for decedents who died on or after July 1 1999. Although the state does not have personal property tax rates there are some counties that do.

26 Zeilen 2020 Maryland Income Tax Rates. Your 2021 assigned rate in the range of 22 to 135 depends on your experience over fiscal years 2017 - 2019. Personal Income Tax for Residents.

For 2020 the rate of withholding for Maryland residents is 575 plus the local tax rate. The income tax withholding formulas for the State and counties of Maryland have changed.

Https Www Marylandtaxes Gov Statepayroll Static Files 2020 Memos Payroll Changes Effective January 1 2020 Pdf

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

Gop Tax Bills Discriminate Against Maryland Seventh State

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Https Www Marylandtaxes Gov Statepayroll Static Files 2021 Memos 2021 Maryland State And Local Income Tax Withholding Information Pdf

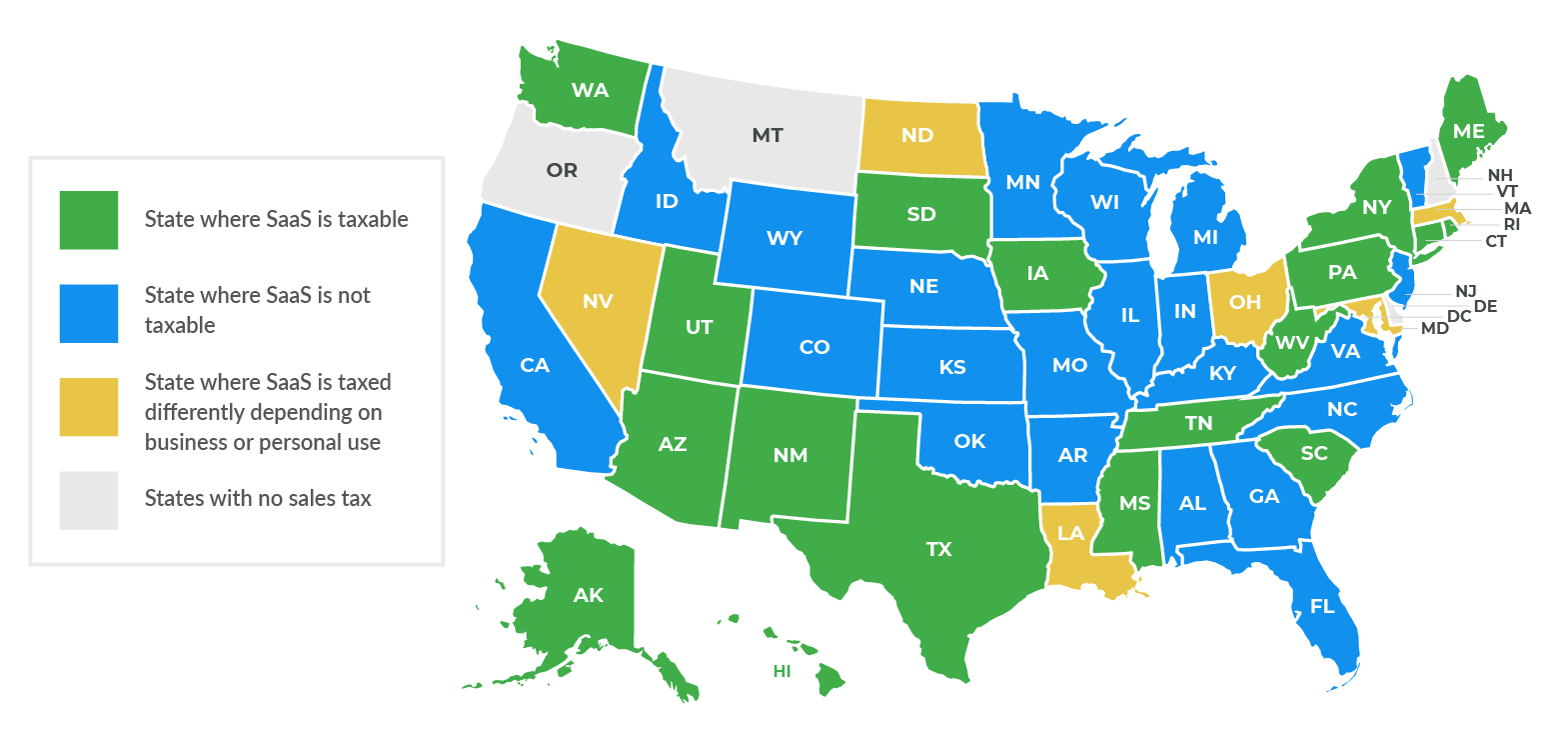

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Tax By State Is Saas Taxable Taxjar Blog

State Corporate Income Tax Rates And Brackets For 2020

State Corporate Income Tax Rates And Brackets For 2020

Individual Income Taxes Urban Institute

Individual Income Taxes Urban Institute

State Income Tax Rates And Brackets 2021 Tax Foundation

State Income Tax Rates And Brackets 2021 Tax Foundation

Comments

Post a Comment