- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

As of late 2012 Series EE bonds issued through December 1982 had ceased earning. Series EE bonds issued before May 1995 earned interest at the higher of market rate or the guaranteed minimum rate.

Solved Suppose You Purchase A Series Ee U S Savings Bond At 50 Chegg Com

Solved Suppose You Purchase A Series Ee U S Savings Bond At 50 Chegg Com

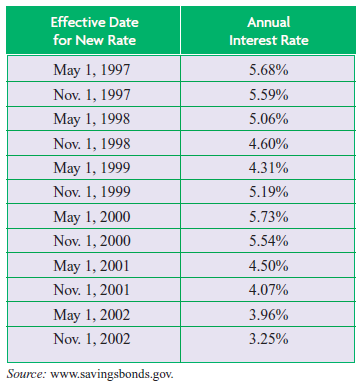

Interest Rates and Terms for Series EE Savings Bonds.

Series ee bonds interest rate. Instead the accrued interest is reflected in the redemption value of the bond. For an EE bond bought from May 2021 through October 2021 the rate is 010. Series I bonds are sold at face value.

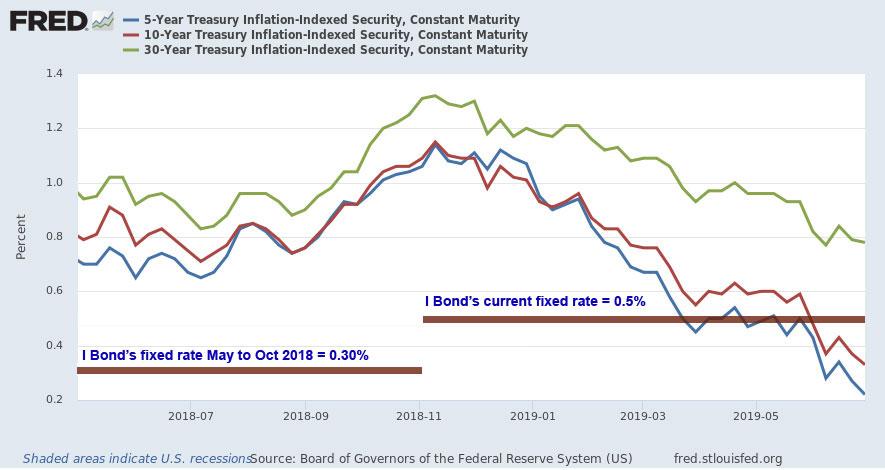

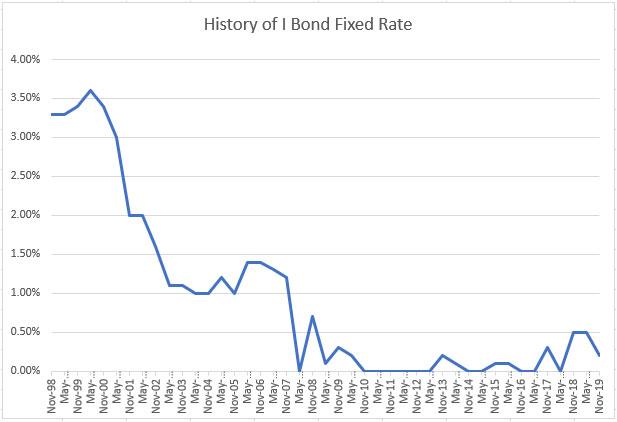

Rates current as of 052018 EE Bonds Issued May 1995 - April 1997. Electronic bonds purchased via TreasuryDirect are sold at. As I had calculated three weeks ago the I Bond inflation rate is 354.

Ie you paid 25 for a 50 bond. The Series I savings bond has no. The rates and terms for an EE bond depend largely on when the bond was issued.

Interest is added to an EE bond monthly and paid when you cash the bond. As an example for the six months ending Nov. Series EE bonds dont pay interest currently.

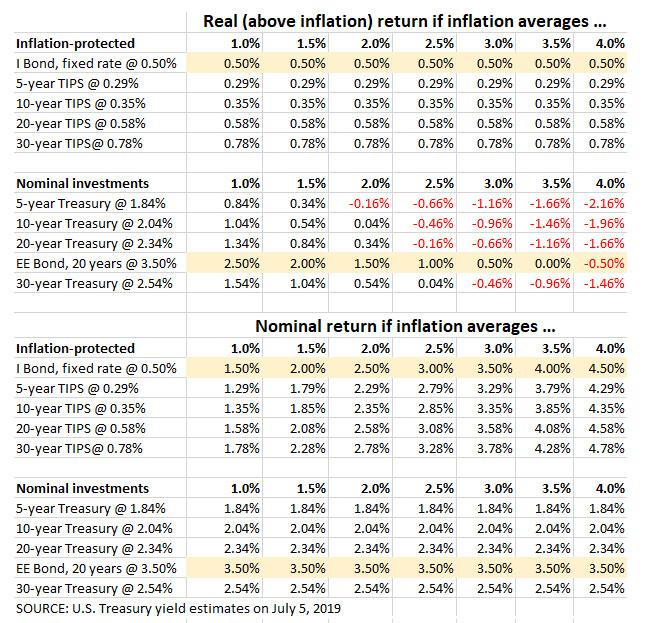

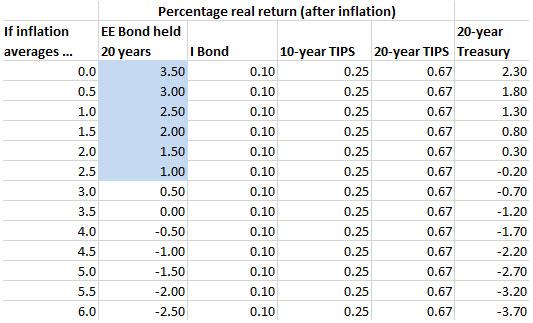

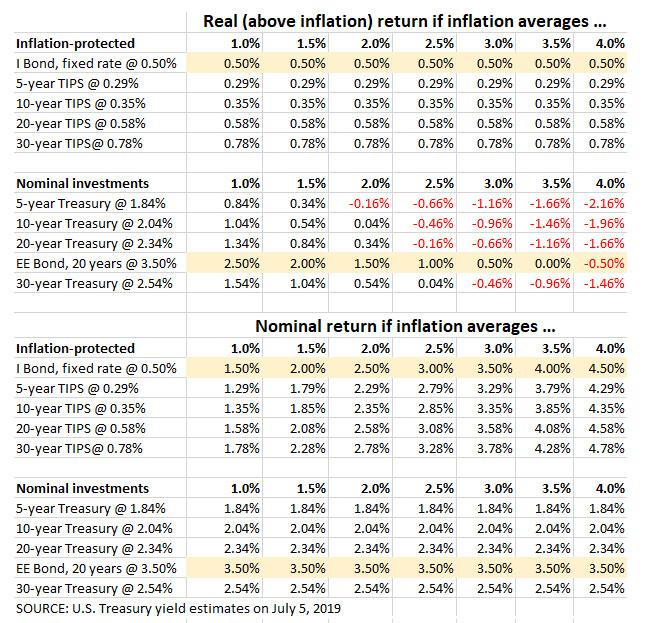

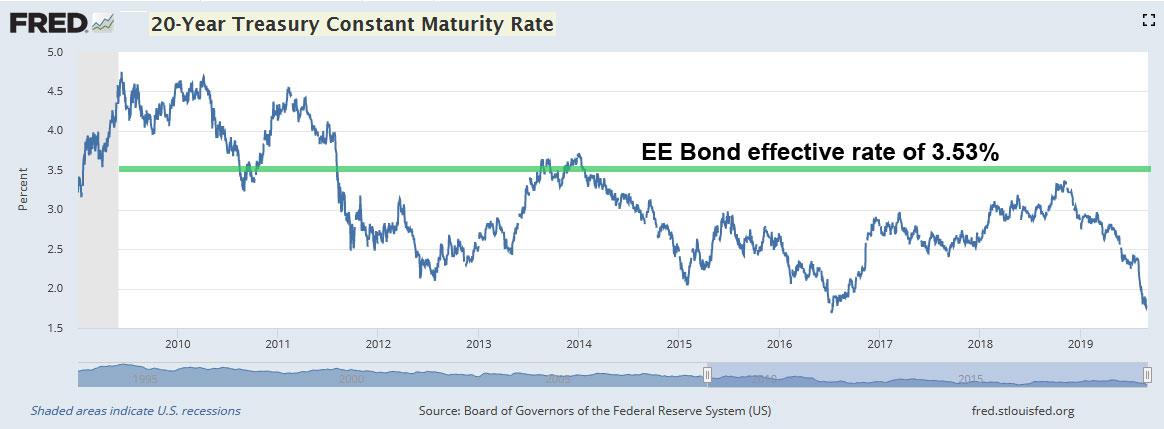

EE bonds issued since May 2005 earn a fixed rate of interest. Using the 20-year target youd need an average 353 annual return on an investment to double your money The minimum purchase price for a Series EE savings bond is 25 with the maximum. Like Series EE bonds interest accrues monthly and is compounded to the principal semiannually.

- April 2020 and will go into effect on the semi-annual period from their issue date. Series EE bonds issued May 2005 and after earn a fixed rate of interest. Series EE Bonds Interest Rate.

Rates paid on series EE bonds are set twice a year in May and November and remain the same for all bonds issued during the following six-month period. EE bonds purchased between May 1997 and April 30 2005 earn a variable rate of interest. These bonds earn market-based interest rates set at 90 of the average 5-year Treasury securities yields for the preceding six months.

More on Rates and Terms. Some bonds may have an interest rate thats quite lowfor example bonds issued from November 2020 through April 2021 earn interest at a rate of 010. Regardless of the rate at 20 years the bond will be worth twice what you pay for it.

The interest on EE bonds isnt taxed as it accrues unless the owner elects to have it taxed annually. No interest is paid on either EE or I bonds until they are redeemed. The current rate for these bonds is 108 Nov.

Paper bonds were sold at half the face value. If I buy an EE bond now what interest will it earn. During times of deflation the negative inflation-indexed portion can drop the combined rate below the fixed portion but the combined rate cannot go below 0 and the bond can not lose value.

50 Zeilen For six-month rate periods that start from May 2021 through October. Treasury issues tables showing the redemption values. Electronic Series EE savings bonds purchased via TreasuryDirect are sold at face value.

Learn more on Interest Rates. The interest rate is fixed for 20 years at the time it is issued. The government may adjust the rate after the 20th year.

This results in a composite I Bond rate of 354. When you buy the bond you know the rate of interest it will earn. Besides being available for purchase online taxpayers may purchase Series I bonds.

Individuals can purchase a maximum of 60000 face. The new interest rate for these bonds effective as the bonds enter semiannual interest periods from May 2021 through October 2021 is 052. If you keep the bond that long we make a one-time adjustment then to fulfill this guarantee.

The interest rate for a bond bought from May 2021 through October 2021 is an annual rate of 010. Yet again the Treasury kept the EE Bond rate the same at 010. 34 Zeilen The annual interest rate for EE bonds issued from May 2021 through.

The Series EE savings bond has a fixed interest rate of return. Regardless of the rate at 20 years the bond will be worth twice what you pay for it. 79 Zeilen For all EE bonds issued before May 1995 the guaranteed rate for.

Paper EE bonds last sold in 2011 were sold at half of face value. Electronic EE bonds are sold at face value with an annual purchase limit of 30000. With this low rate in my opinion the only reason to purchase an EE Bond is if youre planning to hold it for 20 years.

PAPER SERIES EE BONDS ARE SOLD AT 50 of face value with an individual maximum purchase of 60000 face value per year. Government commits that Series EE bonds will double its face value by the 20-year maturity. 30 2019 the interest rate on Series EE.

Series EE bonds issued from May 1997 through April 2005 continue to earn market-based interest rates set at 90 of the average 5-year Treasury securities yields for the preceding six months. For example you pay 25 for a 25 bond.

Yes Ee Bonds Are A Good Investment But If You Re Interested Buy Them Before May 1 Seeking Alpha

Yes Ee Bonds Are A Good Investment But If You Re Interested Buy Them Before May 1 Seeking Alpha

U S Savings Bonds Are A Surprisingly Attractive Investment Right Now Seeking Alpha

U S Savings Bonds Are A Surprisingly Attractive Investment Right Now Seeking Alpha

U S Savings Bonds Are A Surprisingly Attractive Investment Right Now Seeking Alpha

U S Savings Bonds Are A Surprisingly Attractive Investment Right Now Seeking Alpha

How Do Savings Bonds Work The Motley Fool

How Do Savings Bonds Work The Motley Fool

13 Elegant Cashing Series Ee Bonds

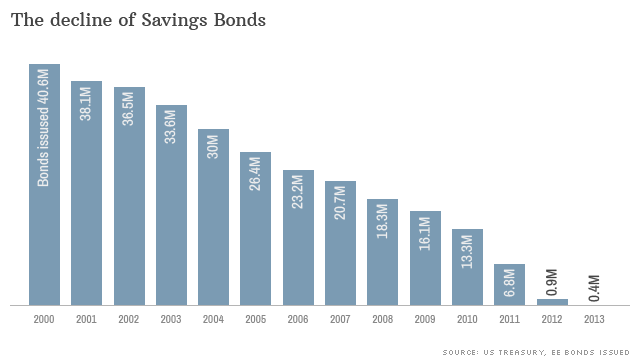

The Death Of U S Savings Bonds

The Death Of U S Savings Bonds

Ridiculous Fact Ee Bonds Are Now A Stellar Long Term Investment Seeking Alpha

Ridiculous Fact Ee Bonds Are Now A Stellar Long Term Investment Seeking Alpha

Valuation Of Ee Savings Bonds Bogleheads Org

Interest Rates On Series Ee And I Savings Bonds Increased In May Announces Savingsbonds Com

Interest Rates On Series Ee And I Savings Bonds Increased In May Announces Savingsbonds Com

Ee Savings Bonds Begin To Invest

Ee Savings Bonds Begin To Invest

Do Savings Bonds Make Good Investments

Bond Basics U S Savings Bonds Kiplinger

Bond Basics U S Savings Bonds Kiplinger

Interest Rate On Series Ee Bonds 1992 Rating Walls

Treasury Slashes I Bond S Fixed Rate To 0 2 Seeking Alpha

Treasury Slashes I Bond S Fixed Rate To 0 2 Seeking Alpha

Comments

Post a Comment